Introduction:

The world of fixed income investing is becoming increasingly complex, requiring investment professionals to adapt and leverage technology-driven solutions to stay competitive and generate superior returns. Artificial Intelligence (AI) has emerged as a game-changer in the investment landscape, empowering investors with advanced tools to construct efficient portfolios and optimize investment strategies.

In this ultimate guide, we explore the value of AI-driven portfolio construction and delve into the features of bondIT’s innovative platform, built to enhance portfolio construction and management capabilities. Learn how bondIT can streamline your fixed income portfolio building process, increase efficiency, and help you achieve better results.

From data-driven security selection to predictive analytics and efficient risk management, harness bondIT’s AI-powered technology and move towards a future-proof investment approach that sets you apart from the competition.

- 1. Data-Driven Security Selection with AI

One of the fundamental steps in constructing an efficient fixed income portfolio is the selection of appropriate securities. AI-driven platforms like bondIT can analyze vast amounts of market data and provide essential insights into individual securities, allowing you to make more informed investment decisions.

bondIT’s machine-learning algorithms can identify patterns, trends, and relationships within the data, providing investors with metrics and analysis that would be difficult or impossible to obtain through manual research. This technology screens securities for specific risk factors, credit quality, liquidity, and other relevant criteria, helping you construct a portfolio that effectively aligns with your objectives, risk tolerance, and performance expectations.

- 2. AI-Optimized Asset Allocation

A critical aspect of portfolio construction is determining the ideal asset allocation across various fixed income sectors, industries, and issuers. Striking the right balance between risk and reward through optimal asset allocation is paramount to achieve consistent long-term performance.

bondIT’s AI-driven technology can analyze your target allocations and compare them with existing portfolios, uncovering inefficiencies and suggesting changes to achieve desired results. Machine learning algorithms can model various allocation scenarios, assess potential risks and returns, and identify the asset mix that best fulfills your investment goals while considering various factors such as liquidity, credit quality, and duration.

- 3. Enhancing Portfolio Diversification with AI

Diversification is a fundamental principle in investment management as it helps to reduce the overall risk of a portfolio by spreading investments across different assets and sectors. AI-driven tools, such as bondIT’s platform, can analyze your current portfolio, identify areas of over-concentration or underexposure, and recommend securities that can help enhance diversification.

Machine learning models are capable of simulating various market scenarios to stress-test portfolios and evaluate their resilience under different economic conditions. By leveraging AI-generated insights, investors can make strategic decisions and build more diversified portfolios designed to minimize risk and foster consistent performance.

- 4. Improved Portfolio Risk Management

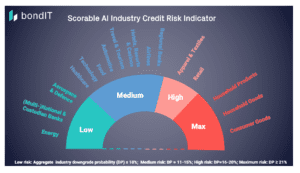

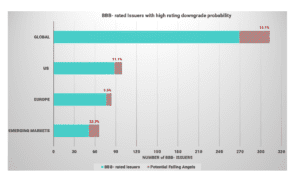

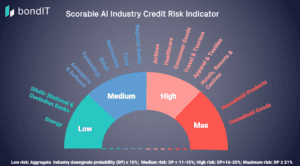

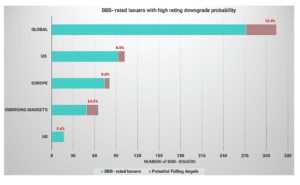

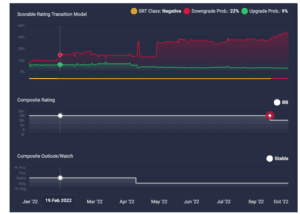

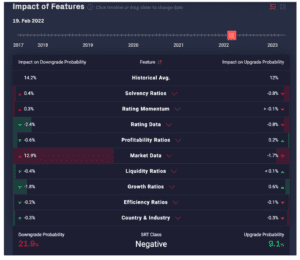

AI-driven systems can contribute significantly to portfolio risk management by analyzing historical data and identifying trends to predict how securities may behave in the future. bondIT’s platform empowers investors with tools to assess and quantify various risks such as credit risk, interest rate risk, and liquidity risk.

Using machine learning models, bondIT can evaluate how these risks evolve under different market conditions, enabling you to make proactive adjustments and optimize your risk management strategies. AI-driven insights on potential risk factors also aid in the development of contingency plans, ensuring that your portfolio remains resilient amidst market fluctuations.

- 5. Ongoing Portfolio Monitoring and Optimization with AI

Effective investment management requires ongoing monitoring and optimization, as portfolios may need rebalancing and adjustment to maintain target allocations, risk levels, and performance expectations. AI-driven platforms like bondIT can consistently monitor your portfolio, evaluating the alignment between your objectives and your current investments.

bondIT’s advanced analytics can alert you to potential performance deviations and suggest alterations based on the ever-changing market landscape. Through continuous analysis of market data, your AI-driven portfolio will be dynamically updated and optimized to help achieve the desired performance and risk levels.

- 6. AI-Driven Scenario Analysis and Performance Forecasting

Predictive analysis plays a crucial role in forecasting future investment trends and portfolio performance. bondIT’s AI-driven platform is capable of running scenario analyses, simulating potential economic events or market fluctuations, and evaluating their impact on your portfolio.

This sophisticated technology empowers you to make informed investment decisions based on future projections, enhancing both the short-term and long-term success of your fixed income investments. By understanding how your portfolio may perform under different scenarios, you can strategically rebalance holdings to maximize gains and minimize losses.

- 7. Personalized Investment Solutions using AI

The power of AI is not limited to aggregate data analysis; it can also be utilized to build personalized investment strategies tailored to individual investors. bondIT’s platform is designed to accommodate your client’s unique financial goals, risk appetite, and investment preferences by incorporating these criteria into the portfolio construction process.

By leveraging bondIT’s AI-driven solutions, you can create customized investment strategies for each client, fostering stronger relationships and earning their trust as you strive to help them achieve their financial objectives.

- 8. Enhanced Decision-Making Through AI-Generated Insights

AI-driven platforms like bondIT enable you to derive insights, identify patterns, and uncover hidden relationships within vast amounts of fixed income data, significantly increasing the efficiency of the decision-making process.

bondIT’s intelligent platform presents actionable information through visualizations, alerts, and suggestions, enabling you to make confident investment decisions without being overwhelmed by the complexity of the fixed income market.

Embracing AI-driven technology can provide a significant competitive edge in your portfolio construction process, delivering better results and fostering growth in your fixed income investments. Through bondIT’s comprehensive platform, you can harness the full potential of AI to enhance efficiency, boost performance, and, ultimately, achieve your investment objectives.

Unlock the Power of AI-Driven Portfolio Construction with bondIT

In conclusion, AI-driven portfolio construction offers a multitude of benefits, streamlining the investment process while enabling investors to make data-driven decisions that drive performance and efficiency. bondIT’s innovative platform can revolutionize your fixed income investment strategy, bolstering your decision-making capabilities with intelligent data analysis and predictive modeling.

It’s time to harness the full potential of AI and optimize your fixed income portfolio construction with bondIT. Request a demo with us today and discover firsthand the benefits of incorporating advanced analytics and AI-driven insights into your fixed income investment process. Embrace the future of portfolio construction and elevate your investment strategy today with bondIT’s cutting-edge technology.