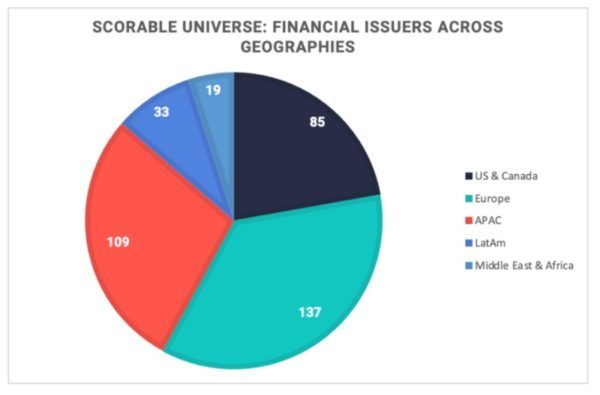

bondIT’s Scorable continues the expansion of its analytical universe with the addition of nearly 400 of the largest financial issuers in the global debt markets. Scorable’s Explainable-AI now predicts changes in the credit risk profiles and rating transition probabilities of banks and financial service providers across the US, Europe, Asia-Pacific and Emerging Markets.

To determine issuer-specific risk profiles, our purpose-built financial model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability and efficiency ratios.

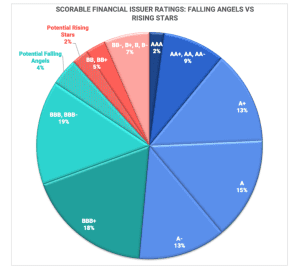

Looking at credit risk across all rating classes, 18% of banks and financial service providers currently show a high probability of a rating upgrade and 14% are at significant risk of downgrade in the next 12 months. However, Falling Angels are likely to outnumber Rising Stars: our Scorable Rating Transition model currently indicates a high downgrade probability for 15 BBB or BBB- rated financial issuers, whereas 9 issuers with BB or BB+ rating are likely to be upgraded in the coming year.

Scorable’s latest universe expansion brings the total number of corporate and financial issuers analyzed to more than 3,300 worldwide.