Scorable Detects Rising Risk of Falling Angels across Europe and the US

January 30, 2024

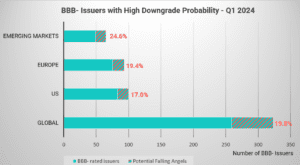

bondIT’s latest credit risk analysis, powered by Scorable, reveals a continued increase in the probability of Falling Angels across Europe and the US. Notably, in Europe, the risk of Falling Angels has risen from 18% to 19.4% in the past quarter. In the US, the percentage of BBB– issuers at risk of a rating downgrade has also increased slightly from 16.7% to 17%, while emerging market issuers have experienced a drop in risk from 26.5% to 24.6%.

The outlook for 2024 is uncertain, with an abundance of challenges ahead. Given the highly volatile global political and economic conditions, it’s crucial for investors to take proactive steps in managing credit risk. The rise of Falling Angels highlights the importance of staying vigilant. Taking a forward-looking approach is key to navigating this complex situation successfully.

bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probability of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month time frame The Rating Transition Model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads, and anticipate rating changes and investment opportunities, ahead of the market.

Want to get access to Scorable to check which of your issuers are at most at risk? Contact the bondIT team for more info.