Turn Data into Actionable Insights; Anticipate critical rating changes ahead of the market

By leveraging the analytical power of Machine Learning and XAI, Scorable Credit Analytics predicts downgrade and upgrade probability of more than 3,000 rated corporate and financial issuers worldwide within a 12-month timeframe.

When it comes to interpreting the ever-growing amount of data, our AI can offer real added value in credit analysis and investment decision-making. Scorable’s Rating Transition model analyses more than 250 unique variables daily and translates raw data from a vast array of sources, including financial statements, fundamentals and capital market data into actionable insights for investors.

With Scorable, asset & wealth managers can broaden their research capacity and efficiently manage their exposures through volatile market environments. Recognizing and understanding market dynamics early on gives them valuable time to adjust their investment portfolios if necessary. Unlike obscure black-box solutions, Scorable’s “Explainable AI” approach supports transparency and allows our clients to understand the drivers behind our risk assessments.

- Data downloads

- Email alerts

- Rating predictions

- Smart lists

- Web alerts

The smartest investment decisions are made using bondIT solutions.

Download Our BrochureWhy use Scorable?

Make well-informed decisions faster, outperform your peers

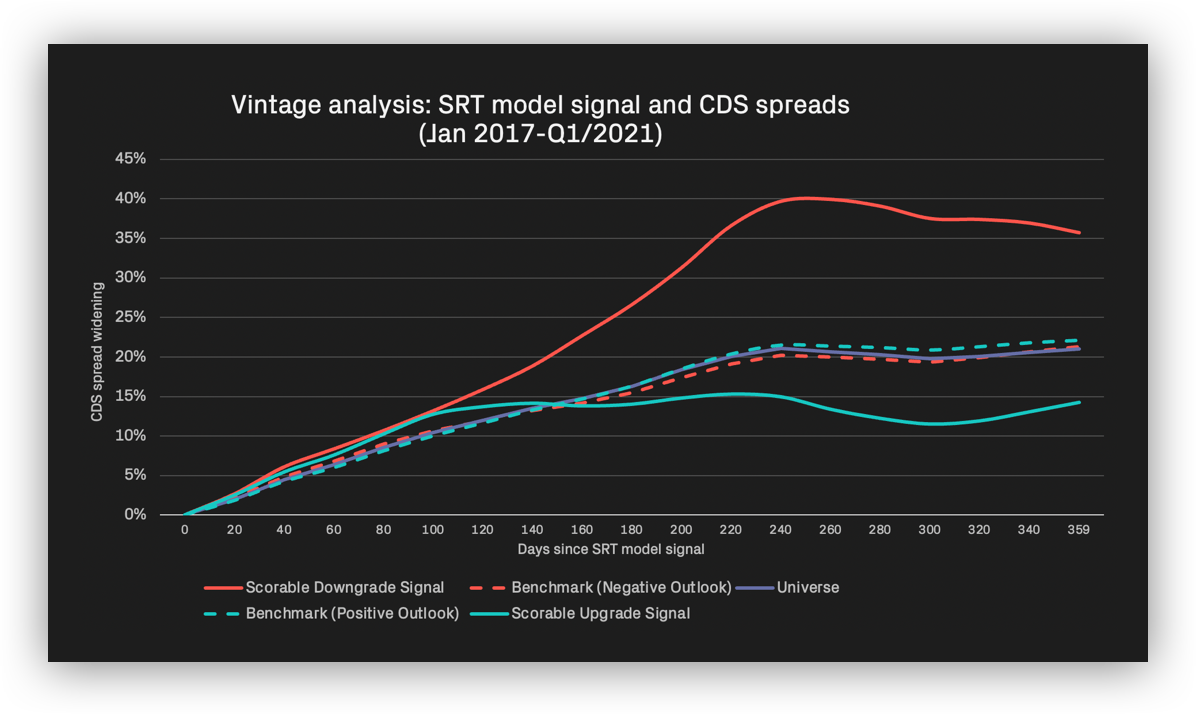

Our performance analysis proves that by using Scorable investors can anticipate changes in corporate bond ratings and credit spread movements ahead of both rating agencies and the markets.

35%

Scorable downgrade signals on average correlate with CDS spread widening of 35% over the course of the following year -- 15 percentage points more than the widening within the overall universe of companies we analyze.

17%

With Scorable, investors can anticipate 17 percentage points more downgrades than by relying on rating agency outlooks. For upgrades, the Scorable model outperforms ratings agency outlooks by 14 percentage points.

Easy to Implement, Intuitive to Use

Scorable integrates with any existing system and doesn’t require additional system development. Our UI is highly intuitive and clients are immediately able to take advantage of the feature-rich and user-friendly interface.

Book a TrialAnticipate Rating Changes

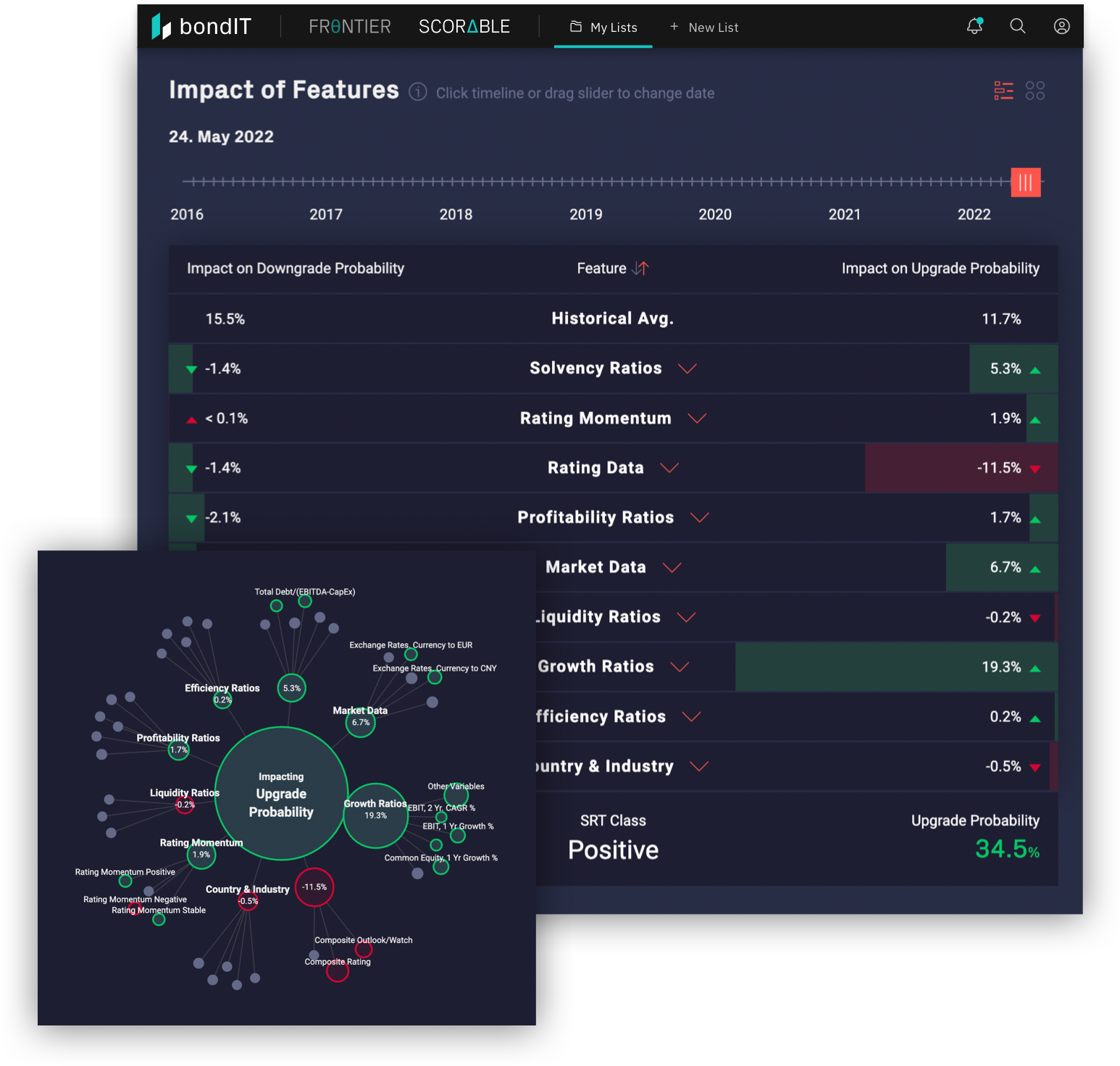

Our AI-based Scorable Rating Transition (SRT) Model combines and contextualizes a wide range of data o assess credit risk. The Issuer History shows developments in the issuer’s credit profile over time. Relative Value classes show whether a company's bonds are cheap or rich compared to other issuers in the same rating bucket.

Get Transparent Insights

Scorable uses a proprietary Explainable-AI approach, so users can see the individual impact of variables on our SRT prediction for any issuer at any given point of their history. Our transparent Machine Learning process allows asset managers to understand the drivers behind our predictions.

Move Ahead of the Market

Smart Lists of buy and sell opportunities combine Rating Transition Probability and Relative Value, allowing users to easily identify trade opportunities ahead of the market.

Customizable alerts notify users of changes in key risk measures for any company within their universe. For extra convenience, users can download model data & alerts.

Tech Deep-Dive

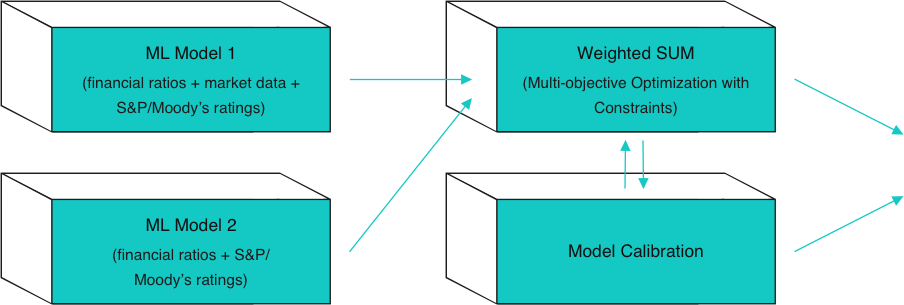

Our stacked model architecture is comprised of two individual ML models. All data input is combined and weighted, determining the significance of each of our around 250 features and it’s individual impact of issuers’ credit risk scores.