Tailor-made investment portfolios for each and every client - at the click of a button

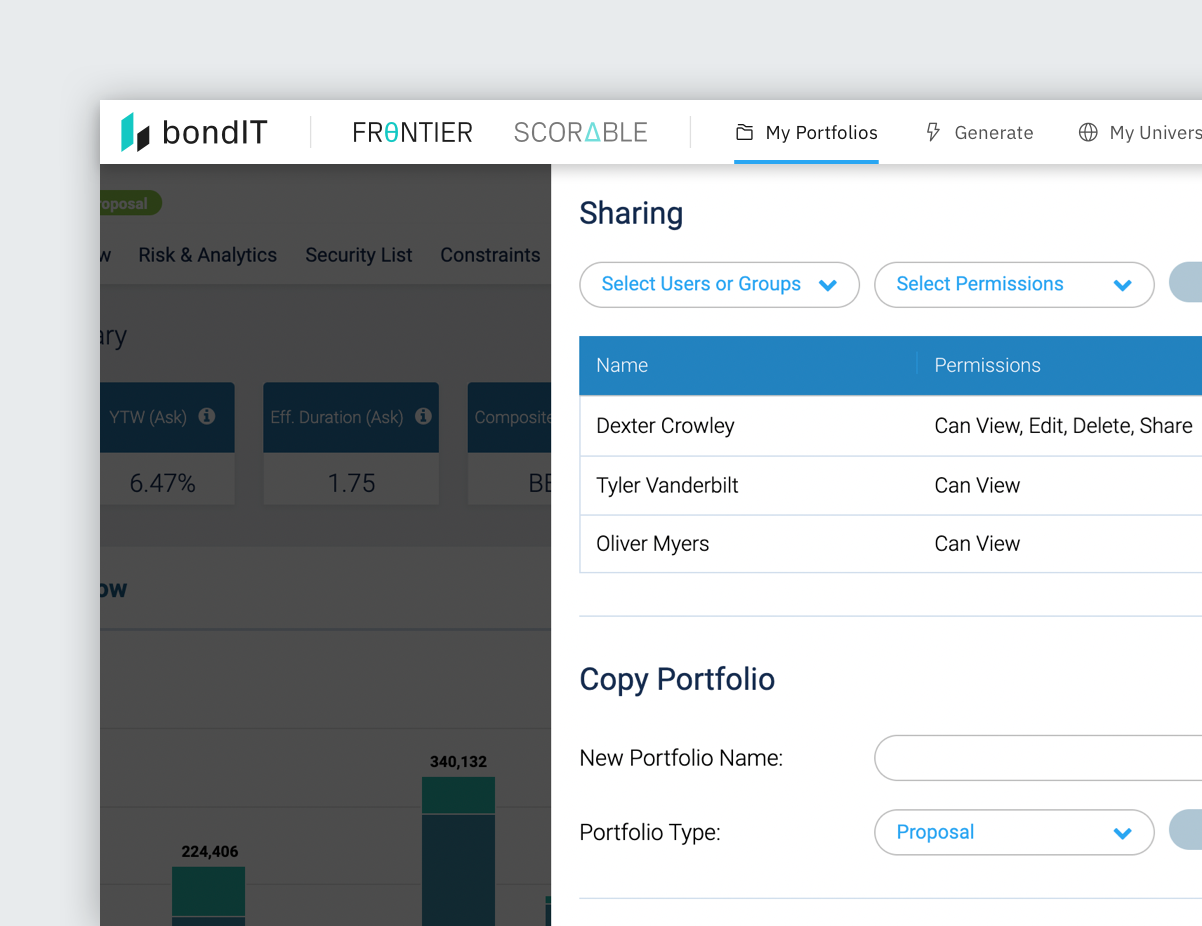

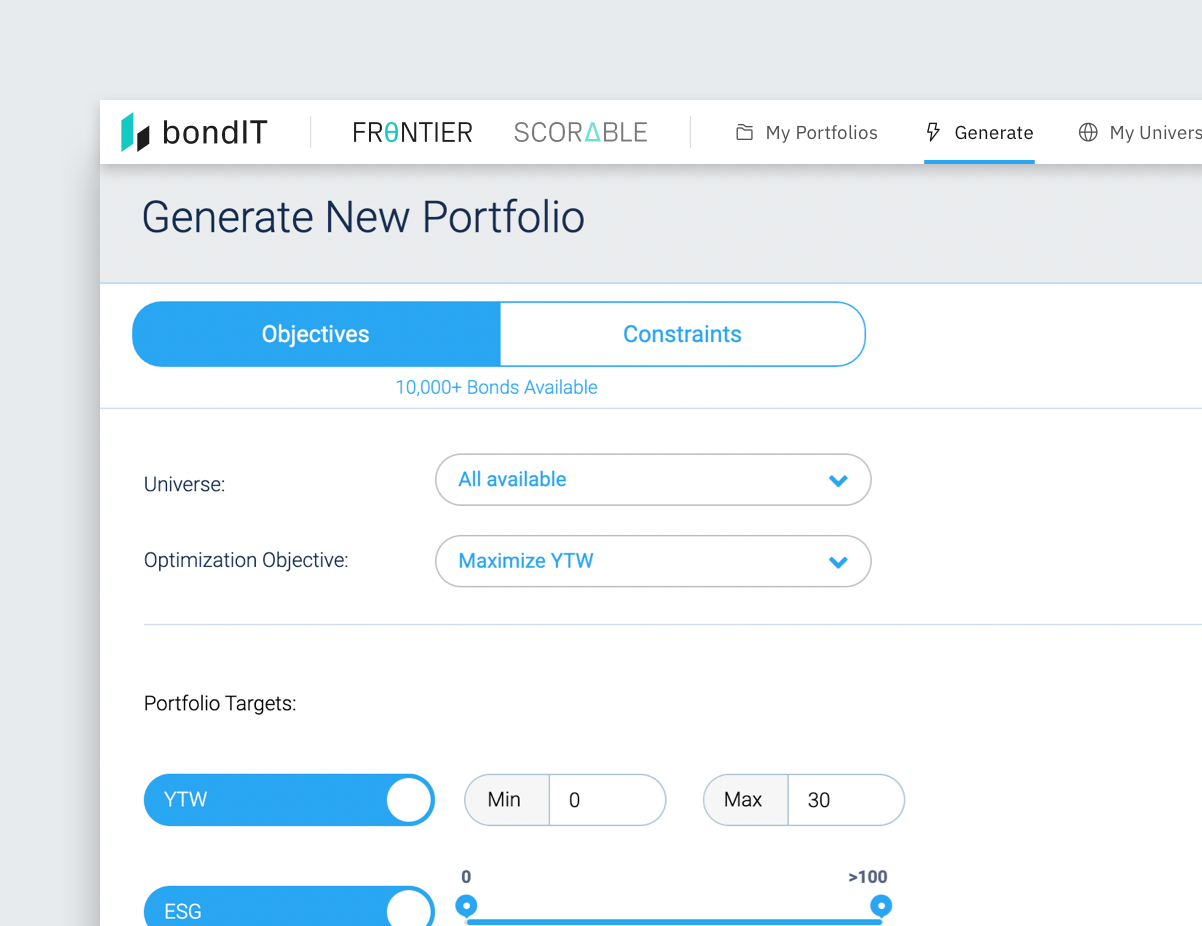

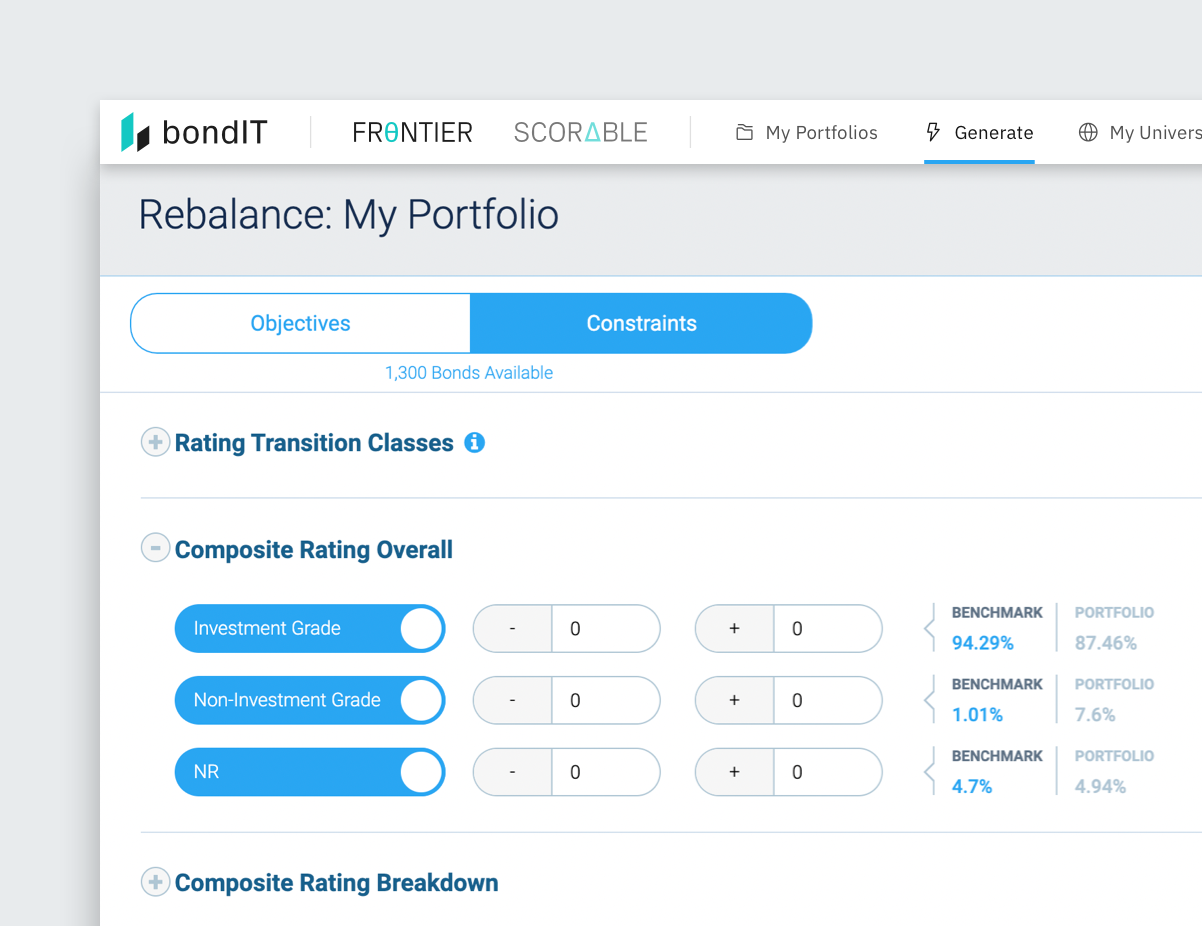

Frontier takes fixed income portfolio management to the next level by delivering data driven, personalized, optimal portfolios. Our system allows clients to generate or rebalance portfolios based on different optimization objectives as well as individually configurable portfolio objectives and bond level constraints with an extremely intuitive user experience.

As a Cloud-hosted, API-ready platform, Frontier seamlessly integrates with proprietary and external data, models, order management and execution systems. It greatly improves the client experience via the construction of personalized tailor-made portfolios and on-demand reports.

Fixed income portfolio optimization and generation happens in minutes rather than hours or days. Our algorithms feature powerful solve anyway functions that can handle compound constraints and mixed integer solutions to deliver the closest portfolio possible, in case not all constraints can be met simultaneously.

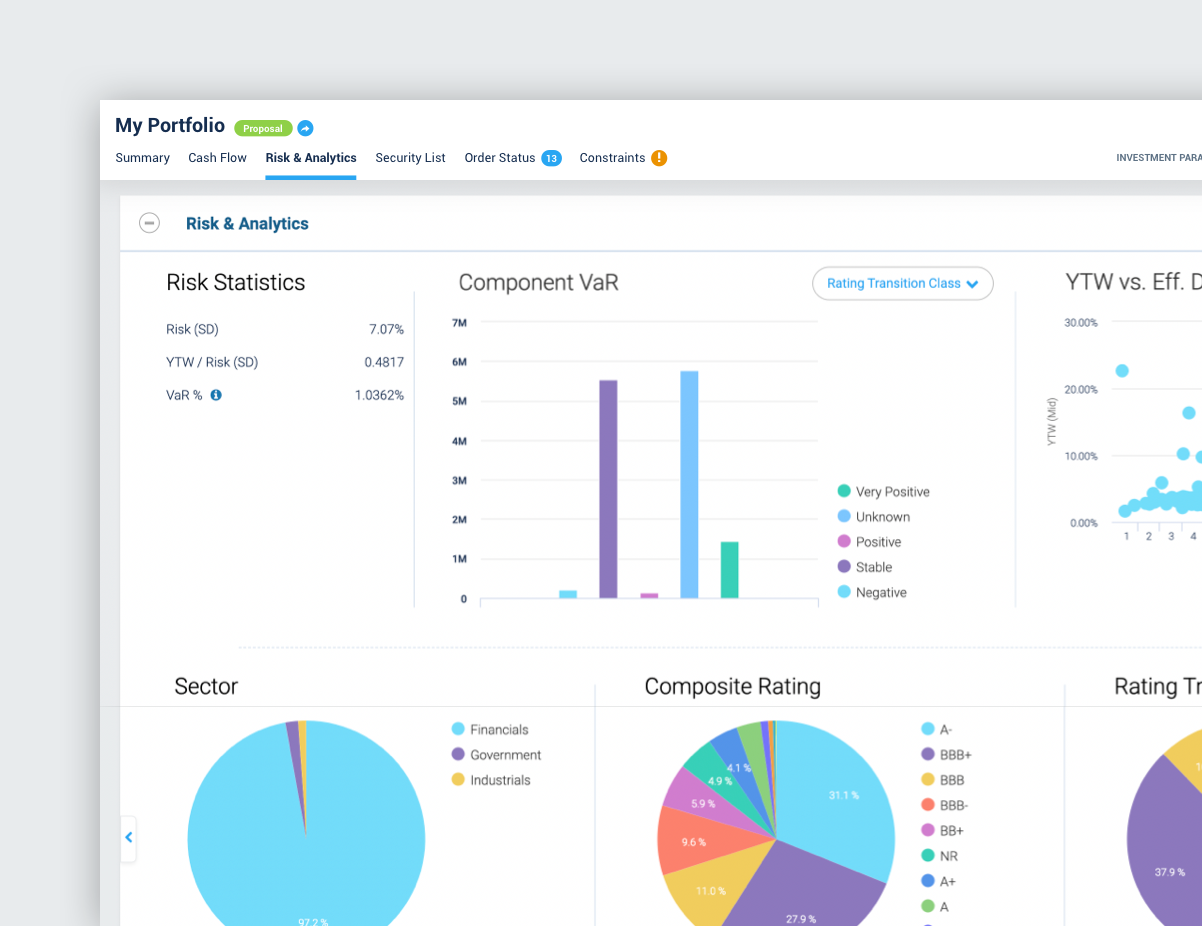

Moreover, Frontier offers multi-level and configurable live analytics on both actual and proposed portfolios.

Digitize your Fixed Income Investing now to navigate challenging markets and gain a lasting competitive advantage.

- Compound constraints

- Data-agnostic

- Liquidity connected

- Mixed-integer solutions

- Non-convex objectives

- Quadratic Approach

The smartest investment decisions are made using bondIT solutions.

Download Our BrochureWhy use Frontier?

Intuitive platform to manage Fixed Income workflows

Our platform is the perfect base to take fixed income processes into the digital era. Frontier’s UX has been built to be used in the easiest, most convenient way and to help our clients significantly increase the efficiency of their portfolio management processes.

Highly customizable and integrable into your workflows

Thanks to our flexible API infrastructure Frontier’s platform seamlessly integrates into companies’ existing processes and workflows to become the center of clients’ fixed income portfolio management. Our system also supports the integration of our clients’ internal or proprietary data.

Incorporating ESG data for market leading strategies

Incorporating ESG considerations is critical to many of our clients’ investment strategy success. Frontier’s data-agnostic and highly flexible technology is able to utilise the widest range of ESG data offered by the market. We work with clients who wish to express activist or impact views, to those wishing to reflect choices or limits, or to those that wish to better understand the implications for these consideration on the return and risk parameters in their portfolios.

Powerful and scalable optimizations, tailored for Fixed Income

bondIT offers various options of portfolio optimization with regards to yields, risk, cash flows and individual constraints – at a speed and a scale that is unmatched in the market. Unlike other solutions, BondIT has been purpose built and optimized for Fixed Income investing and therefore caters to the special investment characteristics of this asset class.

bondIT is a hosted solution that optimizes Fixed Income workflows.

Portfolio objectives and bond level constraints are established as the inputs into the Algorithms. These can all be customized and configured.

Book a Demo

The number of transactions can be specified to control turnover and transaction costs, as well as taking into account increases and decreases in cash positions. Switch proposals are based on mixed integer computing when connected to major liquidity providers to focus on tradable bonds.

Book a Demo

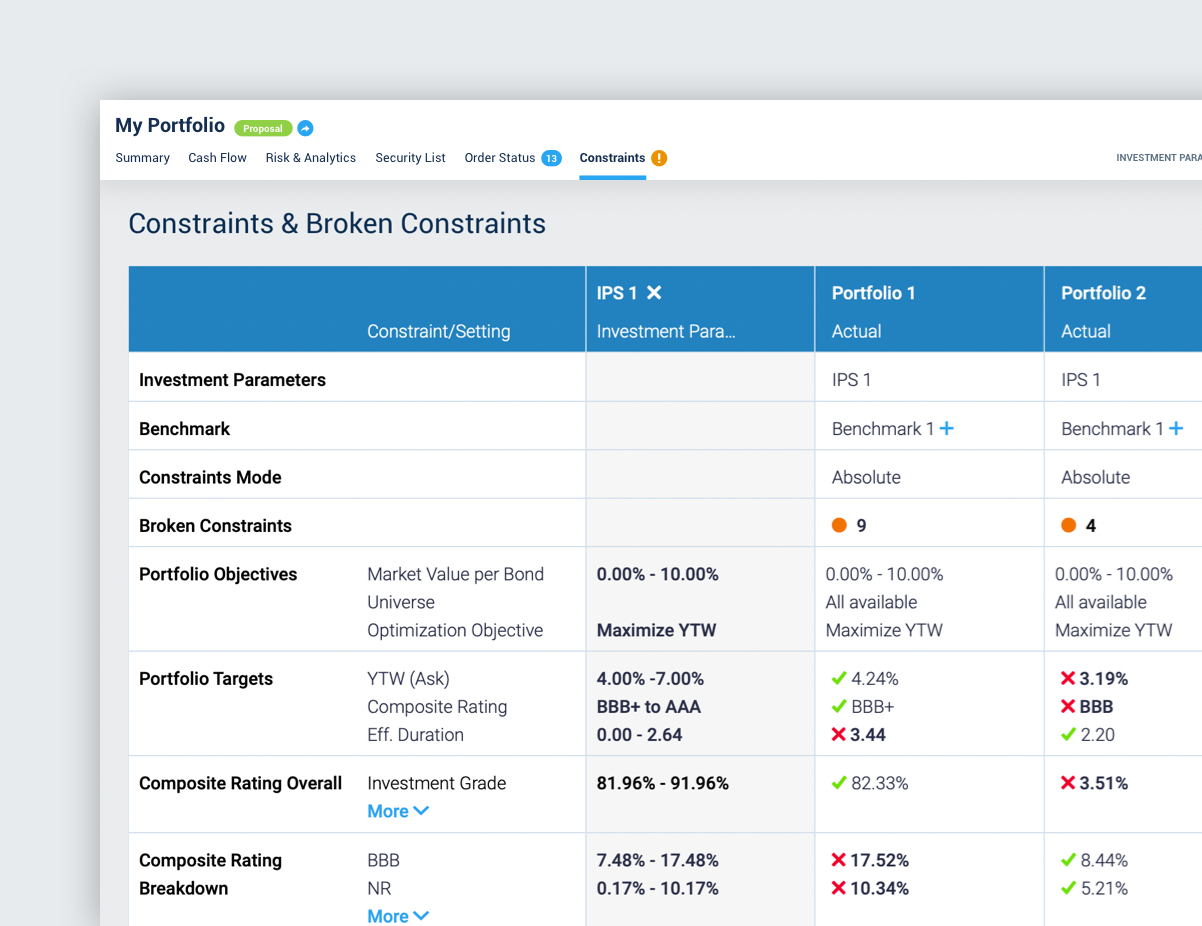

When a portfolio solution is infeasible, the BondIT platform will “solve anyway” and produce the closest portfolio possible, highlighting which constraints were relaxed to achieve the result.

Book a Demo

Frontier offers a full set of configurable analytics across all portfolios – to include any custom data attributes.

Book a Demo

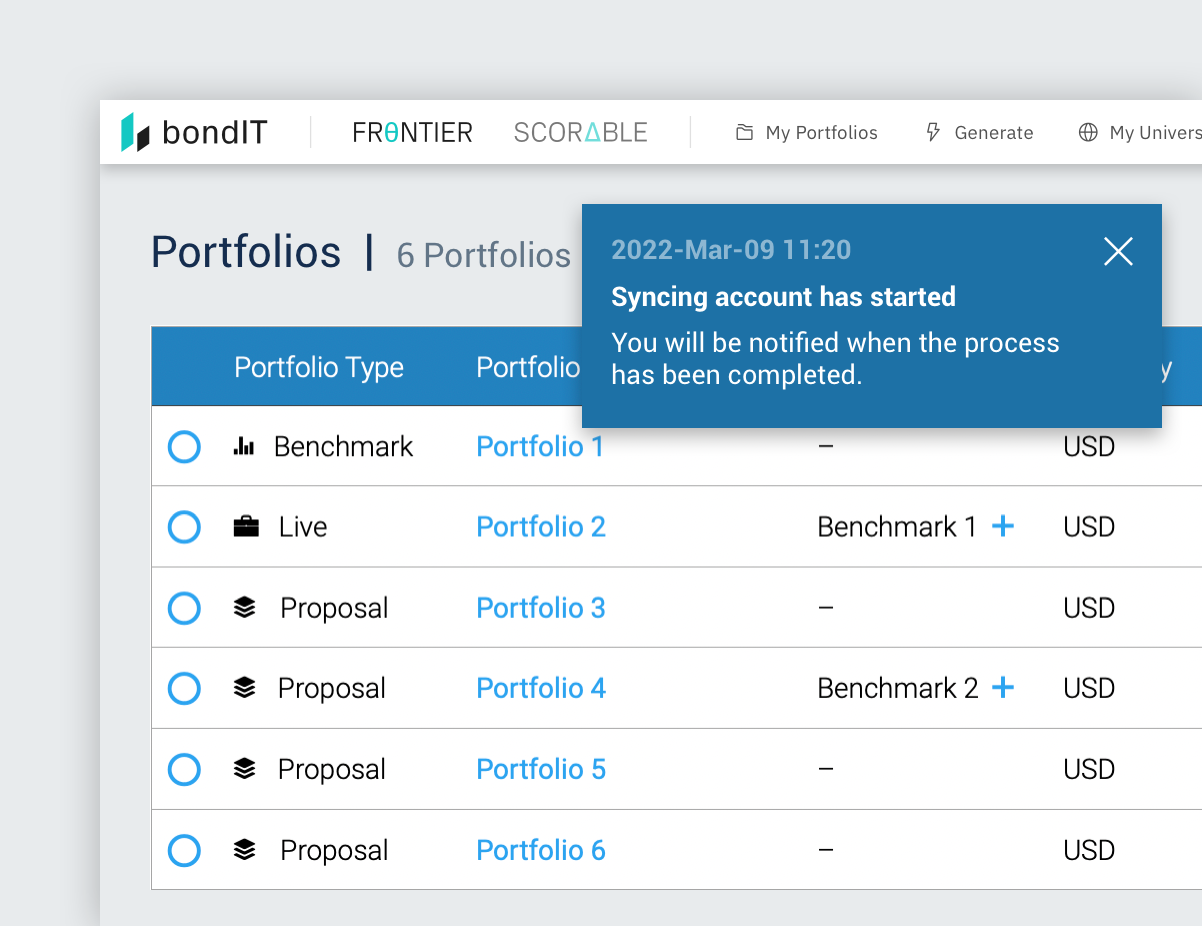

Frontier supports full connectivity with upstream and downstream systems. Portfolios can be imported in real time with a simple copy and paste function.

Book a DemoFrontier Architecture

Discover fixed income portfolio optimization at the click of a button. Our platform will help you make quicker, more informed decisions and enable you to measure market-related and security specific risk exposures for your portfolios.

Services

(“Engine”)