Book Your Demo Now

Investing during Stagflation: What got you here, won't get you there

We are in a unique market environment when compared with the past 40 years. With high inflation and rising interest rates, the economic outlook across the globe is increasingly bleak. Stagflation is bad for bonds in the short-term - and particularly bad for corporate bonds - delivering a one-two punch of higher rates and wider credit spreads to investors’ existing holdings. In the first quarter of 2022, the corporate bond market posted a loss of more than 7% – its worst performance since 1980.

The resurrection of fixed income?

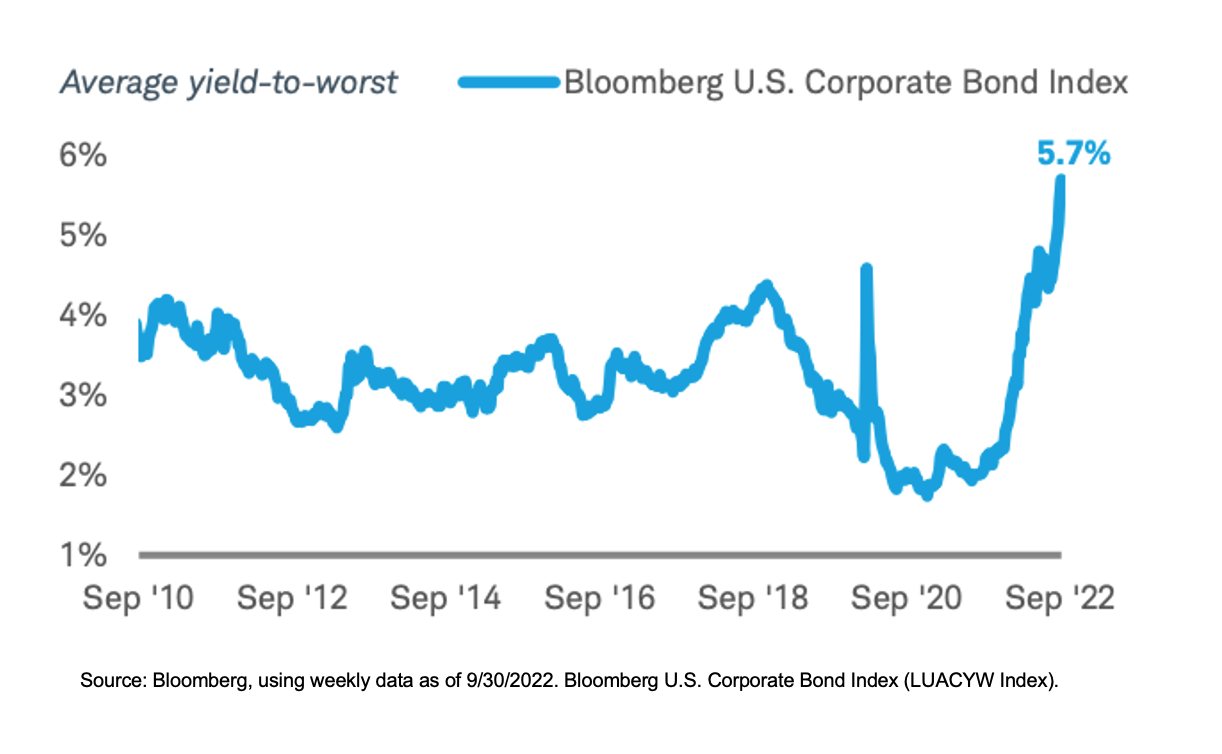

As rates and spreads have moved higher, however, the resulting higher yields provide a buffer against further losses. The fixed income asset class has been resurrected from its forced interment by the Fed to its historically important role of income-producing volatility reduction in portfolio asset allocation.

Investment-Grade Corporate Bond Yields at 13-Year High

Get the Full Report

In spite a challenging market environment, there is now opportunity for investors to generate strong returns – if they manage their exposures well. Forward-looking portfolio optimization, including the ability to anticipate critical rating changes ahead of the market, has become a strategic imperative.

Digitize Your Fixed Income Investing to Navigate Challenging Markets

Technology can significantly augment portfolio management and research processes so that investors can more easily manage risk, discover new investment opportunities, and build portfolios that optimally balance these risks and returns.

Interested to find out more about how AI can help asset & wealth managers anticipate changes in credit risk? Check out our full article, including the latest Scorable Credit Upgrade & Downgrade Forecast to see which industries are most at risk of rating transitions within the next 12 months.

Get The Full Report

Discover bondIT’s unique technology and gain a lasting competitive advantage

Automate Your Investment Process, Access Higher Yields Using Fixed Income Efficiently

bondIT helps wealth managers and financial advisors automate crucial parts of their fixed income investment processes -- so they can manage more accounts and strategies, create portfolio recommendations instantly, improve outcomes and deliver bespoke solutions with the highest degrees of efficiency.

- Create Laddered or Custom Income Streams & Automate Reinvestment

- Avoid Rating Downgrades and Capture Upgrades

Credit and Yield-Optimized Portfolios in Minutes

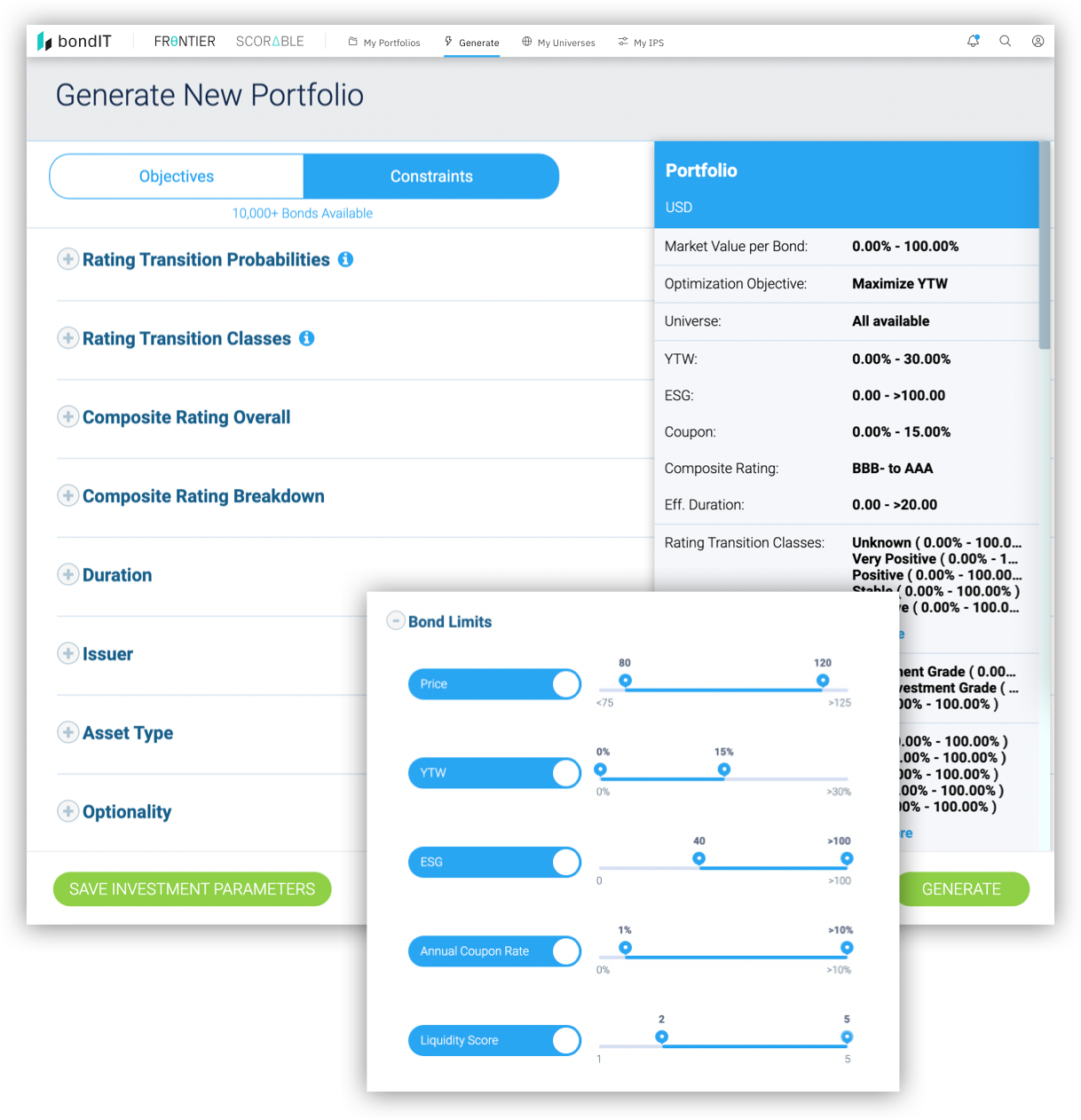

bondIT’s proprietary Portfolio Construction technology, Frontier allows users to efficiently build, optimize and analyze fixed income investment portfolios. What previously took days can now be done in minutes with much greater accuracy as recommendations are based on data-driven analytics. Powered by machine learning and AI, Frontier offers powerful and scalable optimizations across yields, risk, cash flows and individual constraints.

Sustainability & ESG Investing

Integrating ESG factors into the investment process is becoming increasingly important to align with investor values and to mitigate risk, but it should not come at the expense of returns. What sets bondIT’s Frontier platform apart is that it enables investors to maximize ESG scores whilst optimizing other constraints such as cash flow, credit quality and yield simultaneously.

bondIT's data-agnostic technology supports impact investing and allows wealth managers and financial advisors to incorporate the widest range of ESG factors available, ensuring they are well positioned to deliver ESG integrated portfolios whilst maximizing performance.

Anticipate Risk, Identify Investment Opportunities

Better data drives better performance but translating the ever-growing amount of raw data into actionable insights can put a huge strain on resources. This is where AI and automated credit research offers real added value – delivering predictive insights around developing risks and opportunities to support data-driven investing and sound decision-making.

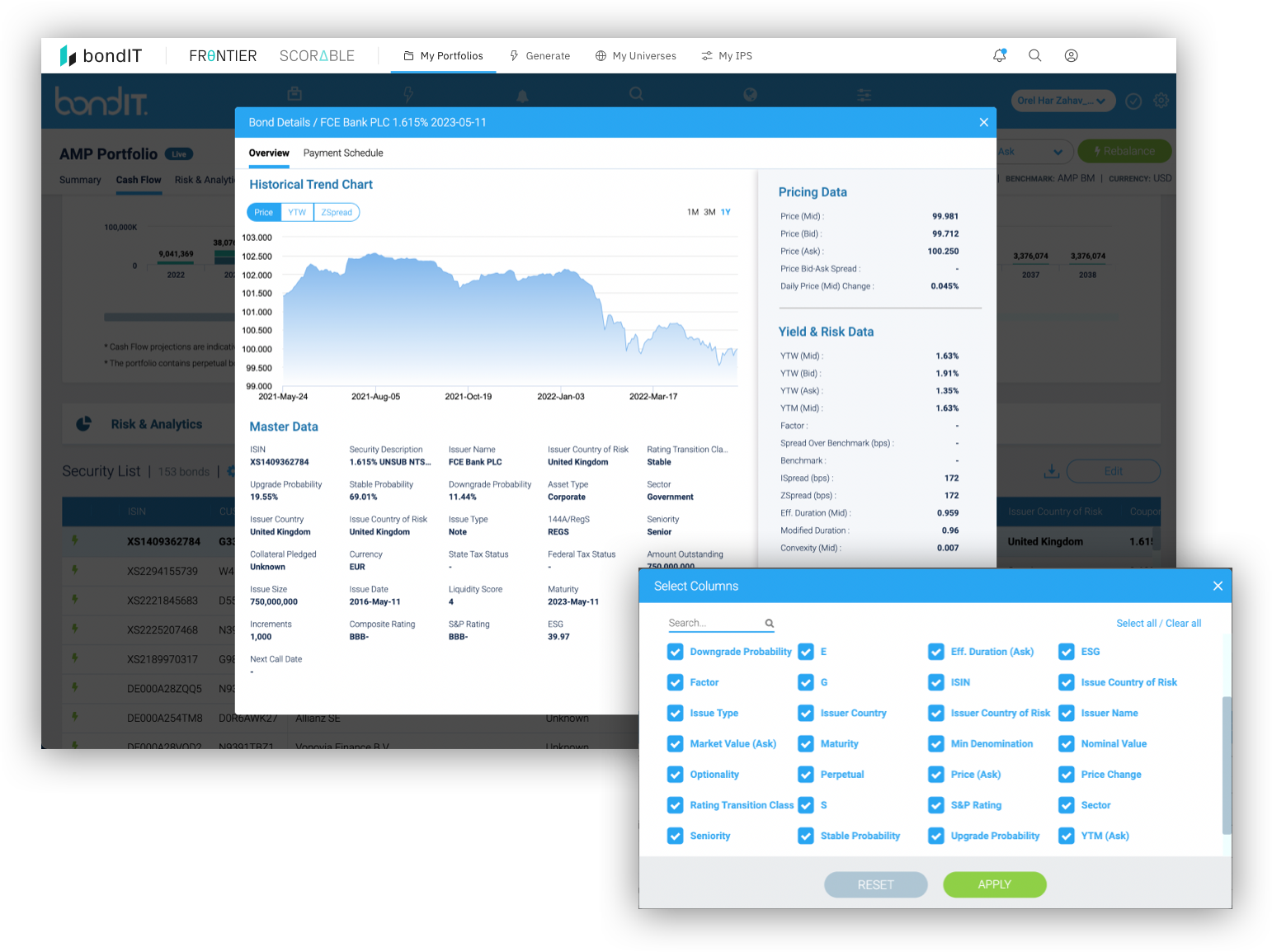

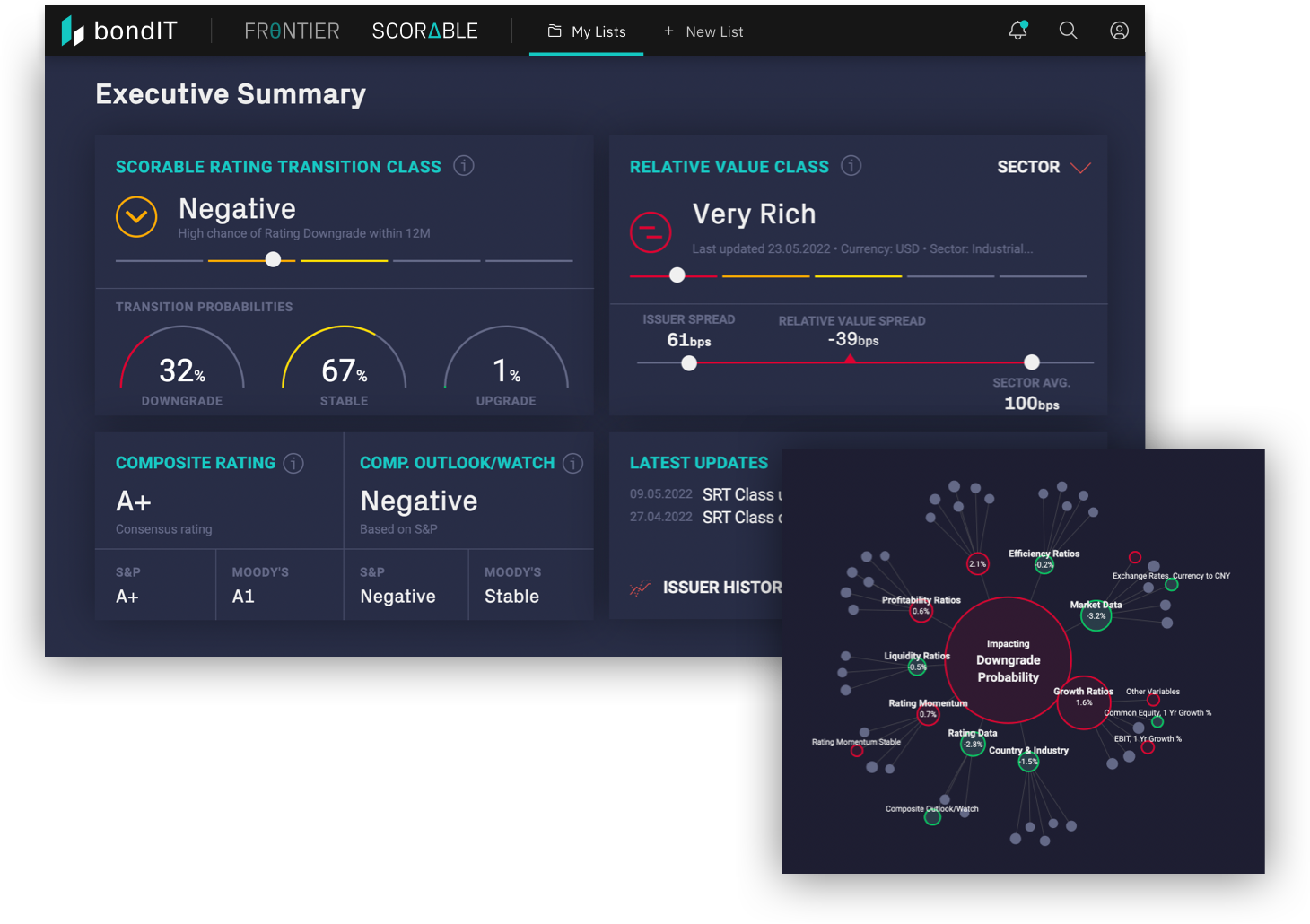

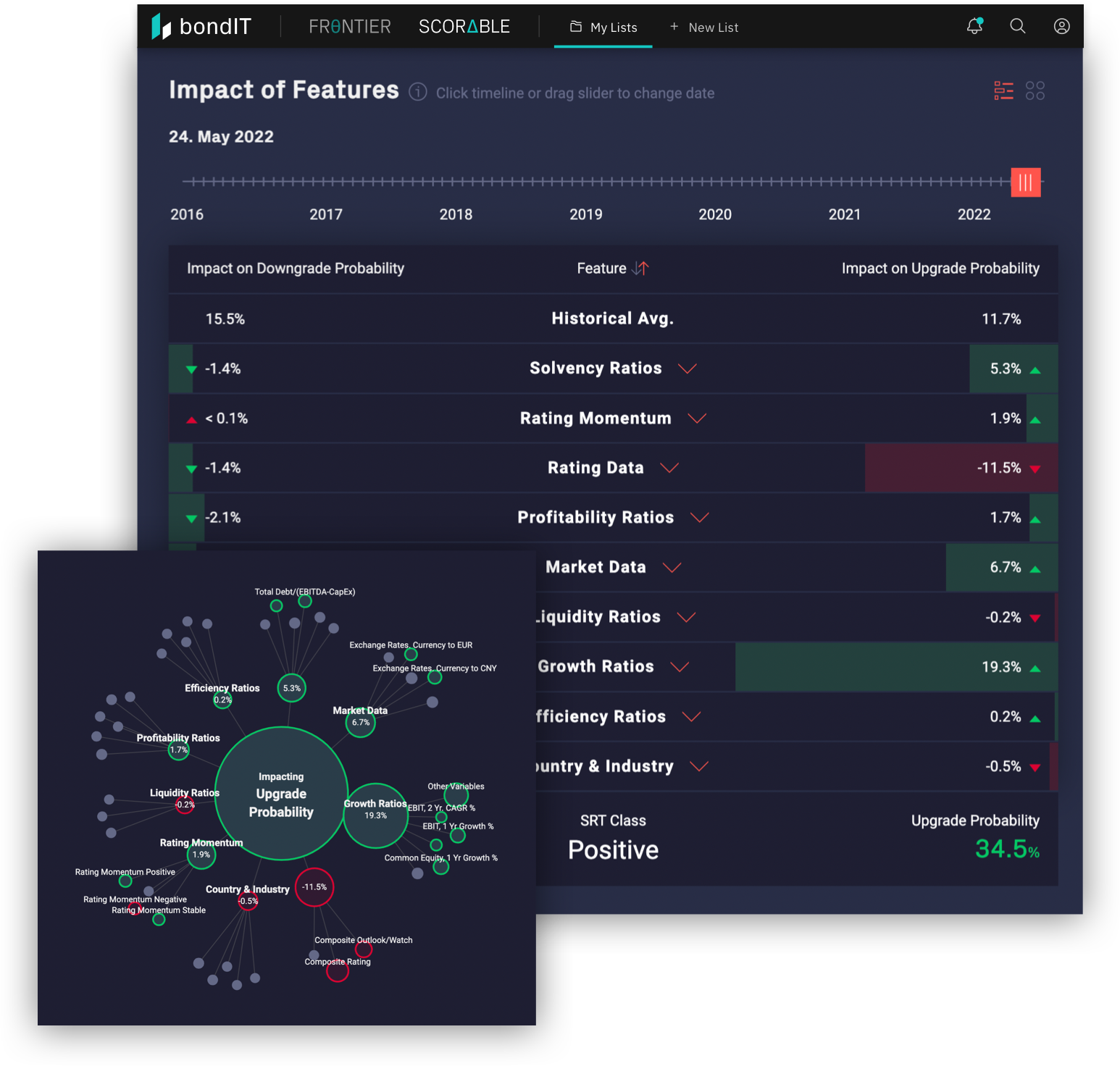

bondIT's AI-based Credit Risk Assessment, Scorable helps investors to effectively manage risk, discover new investment opportunities, and build portfolios that optimally balance risks and returns in this volatile environment. Scorable predicts the downgrade and upgrade probability of more than 3,000 rated corporate and financial issuers worldwide within a 12-month timeframe.

Explainable AI Boosts Transparency & Performance

Our Explainable AI (XAI) analyzes more than 250 data variables totaling 350 Gbytes every day, to determine issuer-specific credit risk to help our clients identify investment opportunities ahead of the market. Our results outperform traditional approaches and unlike “black box” models, our XAI allows users to understand the rationale behind our analysis.

Scorable downgrade signals on average correlate with CDS spread widening of 35% over the course of the following year -- 15 percentage points more than the widening within the overall universe of companies we analyze. By using Scorable, investors can anticipate changes in corporate bond ratings and credit spread movements ahead of both rating agencies and the markets.