Environmental, Social, and Governance (ESG) factors have become increasingly significant considerations for investors, as the awareness of the importance of sustainable, responsible investing grows. In the realm of fixed income investing, integrating ESG criteria introduces new opportunities and challenges that can have a substantial impact on both risk mitigation and returns. By embracing cutting-edge technology, innovative portfolio construction, and AI-driven credit analytics, bondIT’s platform can help investors successfully incorporate ESG factors into their fixed income portfolios, balancing financial objectives with responsible investing.

bondIT’s AI-driven platform not only enhances traditional fixed income portfolio construction but also adapts to integrate clients’ ESG criteria. The result is a powerful approach to fixed income investing that aligns investor values with financial performance, unlocking new opportunities for responsible, long-term growth.

In this article, we will delve into the role that artificial intelligence and machine learning play in incorporating ESG factors in fixed income investing using bondIT’s platform. We will examine the challenges of ESG integration in fixed income portfolios and explore how bondIT’s cutting-edge solutions can help investors overcome these obstacles while unlocking the potential for sustainable investments.

From portfolio construction and optimization to real-time ESG analytics, discover how bondIT is shaping the future of responsible fixed income investing.

Whether you are an experienced fixed income investor, an asset manager, or simply exploring responsible investing, understanding the capabilities of bondIT’s AI-driven platform in the world of ESG fixed income investing can offer valuable insights for driving sustainable, long-term investment success.

The Challenges of Integrating ESG Factors in Fixed Income Portfolios

Incorporating ESG factors into fixed income investing comes with its unique set of challenges. Some of the primary obstacles investors face include:

- Limited ESG data and standardization: Despite growing interest and support for ESG investing, access to standardized, high-quality ESG data for fixed income securities remains limited. This constraint can make it difficult for investors to identify debt securities that meet their ESG criteria accurately.

- Complexity of ESG analysis: Integrating ESG factors within credit analysis can be a complex process that requires assessment of both qualitative and quantitative data. This challenge can be mitigated using machine learning solutions and frameworks that streamline the process.

- Balancing performance and ESG objectives: Striking the right balance between financial performance and ESG objectives can be a challenge for investors when creating fixed income portfolios. This balance often necessitates customization and optimization of investment strategies.

Harnessing the Power of AI and Machine Learning in ESG Fixed Income Investing

bondIT’s AI-driven platform offers investors a powerful tool to overcome the challenges associated with incorporating ESG factors into fixed income portfolios. Key features of their platform include:

- Comprehensive ESG data inclusion: bondIT’s highly flexible platform enables users to include their proprietary ESG data, ensuring investors can make informed decisions when evaluating the sustainability and responsibility of fixed income securities.

- Customizable ESG parameters: Investors can configure their investment strategies by incorporating weightings for different ESG factors, reflecting their preferences and objectives.

- Dynamic ESG portfolio construction: bondIT’s platform can generate optimal fixed income portfolios that balance investors’ financial goals and ESG criteria, allowing users to attain positive risk-adjusted returns while adhering to their responsible investing values.

Enhancing ESG Fixed Income Portfolio Performance and Risk Management

bondIT’s AI-driven platform offers advanced analytics and tools that empower investors to optimize their fixed income portfolios incorporating ESG factors:

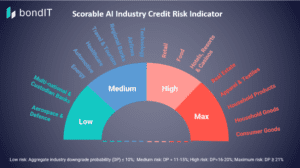

- Risk management: bondIT’s advanced analytics help users identify, measure, and manage potential risks associated with their fixed income portfolios, allowing them to develop more resilient investment strategies.

- Portfolio optimization: bondIT’s AI-driven platform can generate optimized fixed income portfolios tailored to investors’ risk profiles, financial objectives, and ESG preferences, maximizing potential returns while minimizing risk exposure.

- Performance assessment: bondIT’s platform features comprehensive reporting capabilities that enable investors to monitor their fixed income portfolios’ performance against relevant ESG benchmarks, providing valuable feedback for refining investment strategies.

Building a Sustainable Future with bondIT’s ESG Fixed Income Solutions

By investing responsibly, fixed-income investors contribute to a more sustainable future, promoting practices that benefit society, the environment, and the broader economy. bondIT’s AI-driven platform serves as a valuable asset in the pursuit of ESG investing goals:

- Encouraging responsible corporate behavior: By incorporating ESG factors into fixed income investing, investors signal their support for responsible corporate behavior and influence issuer actions positively.

- Fostering long-term value creation: ESG integration within fixed income investing encourages long-term thinking and value creation, as companies that prioritize environmental, social, and governance practices often exhibit more sustainable growth patterns.

- Enhancing stakeholder engagement: By integrating ESG factors into fixed income portfolios, investors can drive meaningful dialogue with issuers, governments, and regulators on issues such as climate change, social inequalities, and corporate governance.

Achieve Sustainable Investment Success with bondIT’s AI-Driven ESG Fixed Income Solutions

Incorporating ESG factors into fixed income investing can unlock tremendous potential for responsible, sustainable growth. bondIT’s cutting-edge AI-driven platform enables investors to integrate their ESG criteria seamlessly, empowering them to create optimized fixed income portfolios that align with their values and financial objectives.

By harnessing the power of artificial intelligence and machine learning, bondIT’s platform is revolutionizing the ESG fixed income investing landscape – streamlining the investment process, enhancing portfolio performance, and fostering a sustainable future for all.

Don’t miss out on the potential for impactful ESG fixed income investing. Request a demo of bondIT’s AI-driven platform today and begin your journey towards responsible, sustainable investment success.