Surging Credit Risk Across Diverse Industries Signals Investor Challenges; Falling Angels to Soar in Europe & US

November 8, 2023

- Number of industries in the maximum risk category surges from three to five

- Risk of Falling Angels rises sharply, doubling in Europe.

New York/Tel Aviv (Herzliya) – The latest Scorable AI Industry Credit Risk Indicator Q4 report released by bondIT, a leading provider of credit analytics and next-generation investment technology, unveils a deterioration in credit risk across the globe.

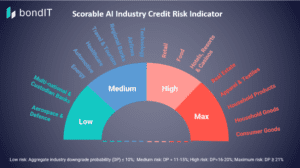

Amidst economic uncertainties and geopolitical tensions, the number of industries sliding into the maximum risk category has spiked from three to five compared to the previous quarter. This concerning trend points to a higher likelihood of rating downgrades in the coming months, posing challenges for investors.

Household Products (24%), Household Goods (23%), and Consumer Goods (22%) persist as the most vulnerable sectors, displaying the highest aggregate risk of rating downgrades in the next 12 months. Joining their ranks are Real Estate and Apparel & Textile, both now standing at 22%, having transitioned from high risk to the maximum risk category. Moreover, the food industry has seen its aggregate credit risk increase to 17%, marking a shift from medium to high risk.

David Curtis, Head of Global Client Business at bondIT, emphasized the critical importance of proactive risk management, stating, “The rise in Falling Angels and the overall escalation in credit risk across diverse sectors underline the urgency for investors to be vigilant. This challenging environment calls for a proactive approach, encouraging investors to embrace innovative strategies, harness the power of advanced analytics, and leverage cutting-edge technologies to uncover opportunities amidst the risks. By staying ahead of the curve, investors can navigate these turbulent times with confidence and make informed decisions.”

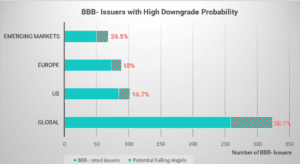

bondIT’s latest report reveals a sharp increase in the probability of Falling Angels. Currently, 20.1% of BBB- issuers globally show a high risk of a rating downgrade in the next 12 months, compared to 14.1% in the previous quarter. Notably, in Europe, the risk of Falling Angels has nearly doubled, rising from 9.5% to 18%. In the US, the percentage of BBB- issuers at risk of a rating downgrade has increased from 11.1% to 16.7%, while emerging market issuers have experienced a rise from 24.6% to 26.5%.

As credit conditions worsen, it becomes crucial for investors to stay informed about the changing risk landscape. bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probability of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month time frame The Rating Transition Model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads, and anticipate rating changes and investment opportunities, ahead of the market.

Want to get access to Scorable to check which issuers are at most at risk? Or discover Frontier, our Portfolio Construction technology with integrated Credit Analytics? Contact the bondIT team now for more info.

* Emerging Markets include Mexico, Brazil, Argentina, South Africa, Poland, Turkey, India, Indonesia, China, and South Korea.