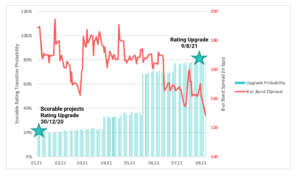

Scorable Credit Research predicted ArcelorMittal’s rating upgrade months in advance, before spreads tightened significantly.

ArcelorMittal was upgraded to BBB- from BB+ in early August 2021

In today’s blog, we take a closer look at how Scorable Credit Research can provide actionable insights to add value to bond portfolios.

On December 30, 2020, the Scorable rating transition model’s prediction for ArcelorMittal crossed the 20% probability threshold, signaling a projected rating upgrade. The two major rating agencies at that time still had Arcelor on Negative Outlook or Stable respectively. The company’s 8yr USD bonds traded at T+180.

By May 16, 2021, Scorable Upgrade probability for Arcelor had grown to 36%, while both agencies still maintained a stable outlook, and ArcelorMittal’s bonds traded at T+170. On August 9, 2021, Moodys upgraded ArcelorMittal´s rating to Baa3 from Ba1 and became the second out of the top 3 rating agencies to rate ArcelorMittal investment grade and bonds traded at T+125. A rising star was born!

Scorable’s unique Explainable AI provides detailed insights on the main drivers for this upgrade prediction: In the case of Arcelor the key factors were the 1Y-growth in EBIT and common equity, as well as equity price returns.

ArcelorMittal: SRT Signal vs Bond Spread

Anticipating market dynamics gives portfolio managers valuable time to adjust their investment portfolio if necessary. With the reduced limit exposure to HY, portfolio managers are now able to add higher yielding BB-names to their portfolio or can reduce risk capital to be allocated to their HY bucket.

Scorable Credit Research helps investment managers to efficiently monitor corporate bonds and credit spreads and to predict rating changes before they occur or markets price them in.

If you would like to find out more about BondIT’s fixed income technology or receive a copy of our brochure, please contact us.