Scorable AI Industry Credit Risk Indicator Report Q2 2023

Elevated credit risk across many industries, risk of falling angels on the rise

- Concentration of industries in medium to high-risk bucket shows heightened rating downgrade risk

- Regional banks at greater risk of rating downgrades than multinational banks

- Regular risk monitoring and rebalancing crucial to achieve investment goals

The latest analysis from bondIT, a provider of credit analytics and next-generation fixed income technology, highlights a concentration of industry risk in the medium to high-risk bracket, indicating elevated credit risk across the world.

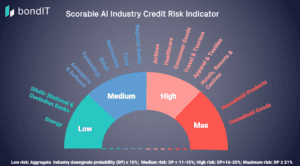

According to bondIT‘s Scorable AI Industry Credit Risk Indicator Q2 report, industries with the highest aggregate risk of rating downgrades in the next 12 months include Household Goods (26%) and Household Products (28%), which comprises beauty, hygiene, health, and nutrition brands.

Rising inflation and economic uncertainty are exerting pressure on disposable incomes and affecting consumer spending, further compounded by increasing production and operating costs, creating a challenging environment for many companies. As a result, aggregated downgrade risk remains high across many sectors, such as Airlines (19%), Tourism (18%), and Consumer Goods (18%).

The recent turbulence in financial markets has reignited concerns about the stability of the banking sector. Scorable’s AI model indicates a higher credit risk associated with regional banks (14%) as compared to multinational and custodian banks, which have been subject to tighter regulations, including regular stress tests and increased capital buffers, following the 2008 financial crisis.

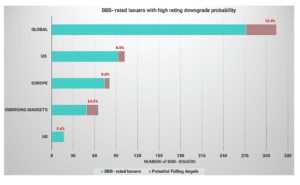

As high market volatility persists, investors need to be selective. Scorable indicates a sizeable amount of rating migrations for corporate and financial issuers in 2023 with the risk of Falling Angels highest in Emerging Markets* where nearly a quarter of BBB- rated issuers display a high or very high downgrade probability. Across the globe, 13.4% of BBB- issuers in the Scorable universe are at risk of becoming Falling Angels within the next 12 months – an increase of nearly 2 percentage points compared to the previous quarter.

However, while rising credit risk may present challenges, investors can still find opportunities to generate strong returns by effectively managing their exposures and building well-diversified portfolios. Anticipating directional credit changes early, regular risk monitoring and rebalancing, can help investors to stay on track towards their investment goals.

bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probability of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month time frame The Rating Transition Model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads, and anticipate rating changes and investment opportunities, ahead of the market.

* Emerging Markets include Mexico, Brazil, Argentina, South Africa, Poland, Turkey, India, Indonesia, China, and South Korea.

Want to get access to Scorable to check which issuers are at most at risk? Contact the bondIT team for help: https://bonditglobal.com/contact/