bondIT’s AI Credit Risk Forecast Reveals High Risk Across Consumer Goods Industries, Improvement in the Travel Industry

July 31, 2023

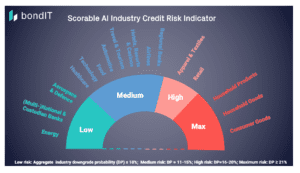

NEW YORK/TEL AVIV (Herzliya), July 31, 2023 — The latest Scorable AI Industry Credit Risk Indicator Q3 report released by bondIT, a leading provider of credit analytics and next-generation investment technology, unveils a diverse range of credit risk levels across industries worldwide.

According to the report, industries with the highest aggregate risk of rating downgrades in the next 12 months include Consumer Goods (22%), Household Goods (24%), and Household Products (26%), which encompasses beauty, hygiene, health, and nutrition brands. These sectors continue to face challenging conditions that contribute to the elevated credit risk.

In contrast, positive developments have been observed in the tourism and related sectors, with the Airline industry experiencing a notable decline in credit risk. The credit risk for the Airline industry dropped to 12 per cent in the third quarter, a significant improvement from 19 percent in Q2. Additionally, the aggregate credit risk in the Travel & Tourism industry decreased by 3 percentage points to 15 per cent. This decrease can be attributed to pent-up demand in the wake of Covid, giving the travel industry a much-needed boost.

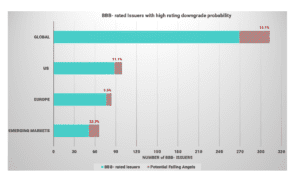

Dr. David Curtis, Head of Global Client Business at bondIT, commented on the findings, stating, “Credit risk is a mixed bag at the moment. While we have seen an improvement in the Travel & Tourism sector, credit risk across consumer and retail sectors remains stubbornly high. Despite the challenges, there are great opportunities in the market now, particularly with the increased yield that many issuers are offering. Investors need to be vigilant though, as our Scorable AI is also signaling an increased risk of Falling Angels.”

The report indicates that the probability of Falling Angels, though rising slightly, remains a point of concern. Currently, 14.1% of BBB- issuers globally show a high risk of a rating downgrade in the next 12 months. Emerging market issuers have experienced a slight decrease in this risk, from 24.6% to 22.7%. However, the risk of Falling Angels in the US and Europe has increased, from 8.8% to 11.1% and 8.4% to 9.5% of BBB- issuers, respectively.

As credit conditions continue to evolve, it becomes crucial for investors to stay informed about the changing risk landscape. bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probability of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month time frame The Rating Transition Model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads, and anticipate rating changes and investment opportunities, ahead of the market.

Want to get access to Scorable to check which issuers are at most at risk? Contact the bondIT team.

* Emerging Markets include Mexico, Brazil, Argentina, South Africa, Poland, Turkey, India, Indonesia, China, and South Korea.