The two firms announce their collaboration to advance traders’ ability to anticipate critical market changes

NEW YORK/TEL AVIV (HERZLIYA), December 18 2023 – Liquidnet, a leading technology-driven agency execution specialist, and bondIT, a leading provider of next-generation investment technology, announced today their partnership to integrate bondIT’s Scorable Credit Analytics into Liquidnet’s Fixed Income electronic trading platform. The collaboration aims to empower traders to anticipate market trends, mitigate credit risk and make informed investment decisions faster.

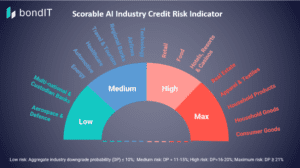

Leveraging data science, Explainable AI (XA) and Machine Learning expertise, bondIT’s Scorable enables fixed income investors to anticipate changes in credit ratings and spreads, and identify investment opportunities ahead of the market. With this integration, the 700+ fixed income member firms who currently have access to Liquidnet’s primary and secondary market trading protocols for corporate bonds, will gain access to valuable insights and a more informed view on credit markets directly within their Liquidnet application.

Nicholas Stephan, Global Head of Fixed Income Product and Partnership Programs at Liquidnet, said: “We are thrilled to be able to enrich the Liquidnet platform with a service of Scorable’s caliber. With this integration, our goal is to give access to crucial information to investment firms of all sizes. Our Members will have seamless access to a wide range of credit data giving them an extra edge ahead of making their trading decisions.”

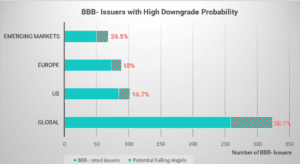

Amidst the most attractive yields in more than a decade, investor demand for fixed income has surged notably in recent months. However, rising concerns over credit risk in a challenging economic and geopolitical climate emphasizes the need for careful investor choices.

Dr. David Curtis, Head of Global Client Business at bondIT, who emphasized the significance of this collaboration, added: “Bonds are back, but so is risk. Technology becomes an ever more important ally in this dynamic financial landscape. The synergy between bondIT’s AI-driven Scorable Credit Analytics and Liquidnet’s platform empowers traders with actionable insights, enabling them to stay ahead in today’s volatile markets.”

This latest collaboration represents one of many new additions planned that highlights Liquidnet’s commitment to advance its Liquidnet Credit offering beyond an execution system.

– END –

About Liquidnet

Liquidnet is a leading technology-driven, agency execution specialist that intelligently connects the world’s investors to the world’s investments. Since our founding in 1999, our network has grown to include more than 1,000 institutional investors and spans 49 markets across six continents. We built Liquidnet to make global capital markets more efficient and continue to do so by adding additional participants, enabling trusted access to trading and investment opportunities, and delivering the actionable intelligence and insight that our customers need. For more information, visit www.liquidnet.com and follow us on Twitter @Liquidnet.

About TP ICAP Group plc

TP ICAP is a world-leading markets infrastructure and data solutions provider. The Group connects buyers and sellers in wholesale financial, energy and commodities markets. We are the world’s largest wholesale market intermediary, with a portfolio of businesses that provide broking services, trade execution, data & analytics, and market intelligence. www.tpicap.com

About bondIT

bondIT provides next generation front office investment technology. The company combines data science, explainable-AI (XAI) and advanced technologies with fixed income investment know-how to help improve the performance, accuracy and efficiency of clients’ investment processes and businesses. bondIT is privately owned and paving the way for financial institutions of all sizes to integrate the power of greater technology into their investment processes. bondIT adheres to the highest privacy and security standards and is SOC 2 certified by Ernst & Young. www.bonditglobal.com