Now, let’s revisit how bondIT’s cutting-edge technology empowers wealth managers to redefine their fixed income strategy.

With bondIT, you gain a platform designed specifically for fixed income portfolio management and trading. Our intuitive, cloud-hosted workstation integrates seamlessly with your existing workflows, delivering market liquidity, portfolio management, trade execution, compliance and reporting.

Here’s how bondIT’s Frontier can transform your fixed income portfolio management & trading

- Personalized Optimization: Build client-tailored portfolios with data-driven insights.

- Streamlined Processes: Rebalance portfolios or perform batch rebalances in minutes, not hours.

- Aggregated Live Liquidity: Access more inventory across multiple ATSs and venues, fill more trades, and increase trading flow.

- Batch Processing and Automation: Automate tasks to increase efficiency as your volume grows.

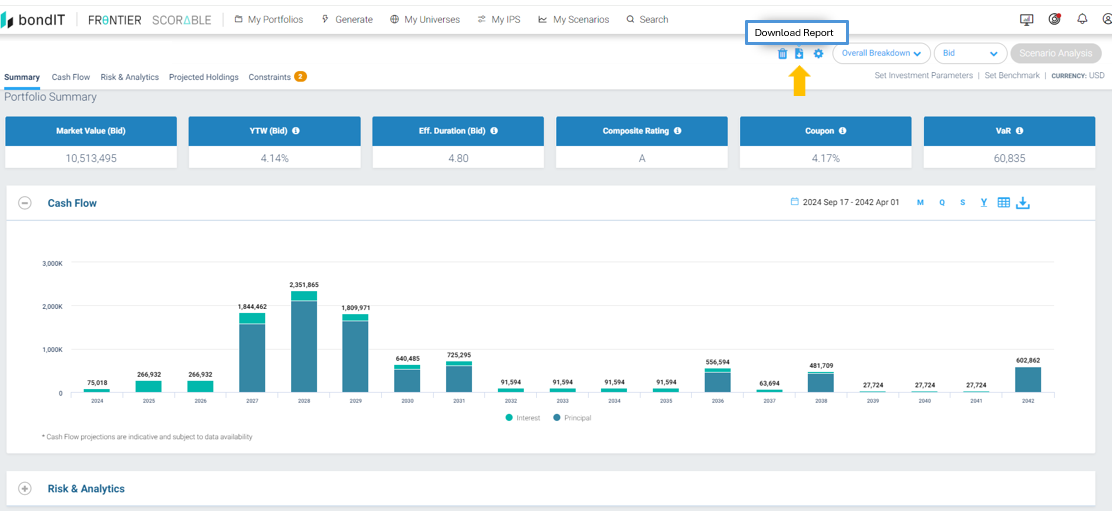

- Comprehensive Analytics: Dive deep into live portfolio metrics and create precise reports.

Your Future-Ready Fixed Income Platform

From creating client-specific strategies to optimizing portfolios with our ‘Solve Anyway’ capability, bondIT ensures your investment decisions are faster, smarter, and more adaptable than ever.

Explore the Highlights

Missed one of the features in the series? Check out our full suite of solutions:

- EasyReporting®: Access an industry-leading suite of fixed income-specific reports.

- SmartSearch®: Instantly find bonds that meet your needs.

- Investment Parameters: Create and manage model-based portfolios.

- Batch Rebalance: Rebalance thousands of portfolios in seconds.

- Scenario Analysis: Anticipate portfolio performance across yield curve scenarios.

Ready to automate your fixed income?

Try bondIT today and see how our scenario analysis functionality can enhance your fixed income strategies. Contact a member of the bondIT team now.