One of the world’s largest financial advisory firms recently adopted bondIT’s Frontier platform to both improve its client offering and streamline its fixed income workflows. Our scalable and customizable platform powered-up their portfolio management processes, allowing central teams to create new portfolio proposals, analyze existing client portfolios, and recommend optimized switch trades across their approved fixed income security list. By integrating bondIT’s advanced features, the firm expanded its range of portfolio options and tailored solutions, particularly for ultra-high-net-worth clients, boosting both operational performance and client satisfaction.

Optimized Central Team Workflow

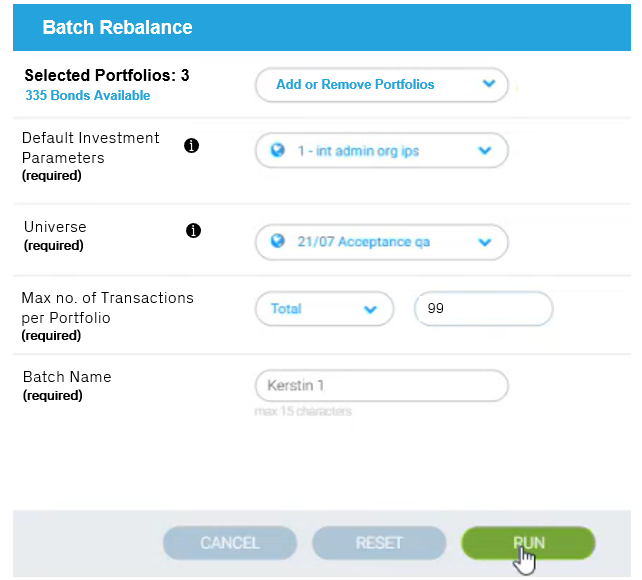

bondIT’s Frontier platform streamlined processes within the firm’s central advisory teams, improving collaboration and operational efficiency. The platform allows users to create custom portfolio proposals, compare existing client portfolios with optimized alternatives, and seamlessly swap fixed income securities in and out of current portfolios.

Enhanced Portfolio Construction and Customization

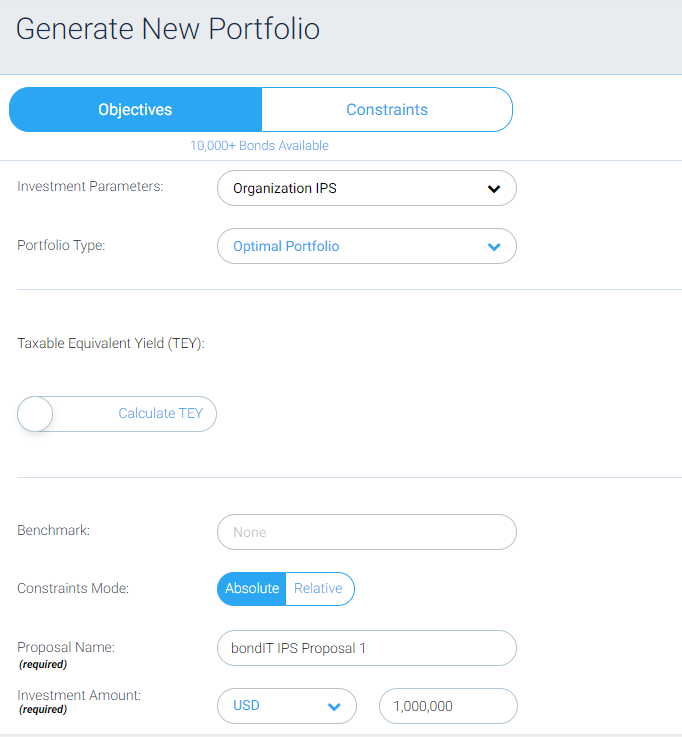

With bondIT, the firm gained the ability to create tailored portfolios based on individual client parameters. The platform supports the ingestion of CSV files containing key financial data such as CUSIP, price, yield-to-maturity, duration, and markup values. The ease of uploading and retaining these files within the platform ensures that the advisory teams have access to essential information for building and reviewing portfolios.

Flexible Reporting and Compliance Tools

bondIT enabled further customization of the portfolio proposal output, including the ability to incorporate essential disclosure language, advisor and client names on cover pages, and to modify templates based on specific client requests. The platform also introduced the ability to include New Issues and Certificates of Deposit within portfolio proposals, further broadening the range of client solutions.

Refined Proposal Templates and Analytics

Through collaborative development with the advisory firm, bondIT enhanced its proposal template by introducing advanced customization options. The new features include, for example, securities listed by type and maturity; removal of non-essential data, in this case Value at Risk and ISIN numbers, and include an adaptable output format where fields can be toggled on or off based on client needs.

Retirement Planning and Specialized Solutions

The firm also leveraged bondIT to develop robust retirement planning solutions that cater to diverse client needs, particularly for ultra-high-net-worth (UHNW) clients. By expanding the range of financial instruments available, the advisory firm now provides more tailored solutions that meet specific long-term financial goals, including retirement income.

Through the integration of bondIT’s Frontier platform, the firm significantly enhanced its ability to serve the most important segment of its client base in UHNW clients by offering specialized financial products and services. The partnership between bondIT and the firm resulted in innovative, flexible, and scalable solutions, enabling the firm to better meet the dynamic needs of its clientele.

Ready to elevate your fixed income solutions and streamline your workflows like one of the world’s largest financial advisory firms?

Contact us today to discover how bondIT’s Frontier platform can help you create customized portfolios, optimize operations, and exceed client expectations.