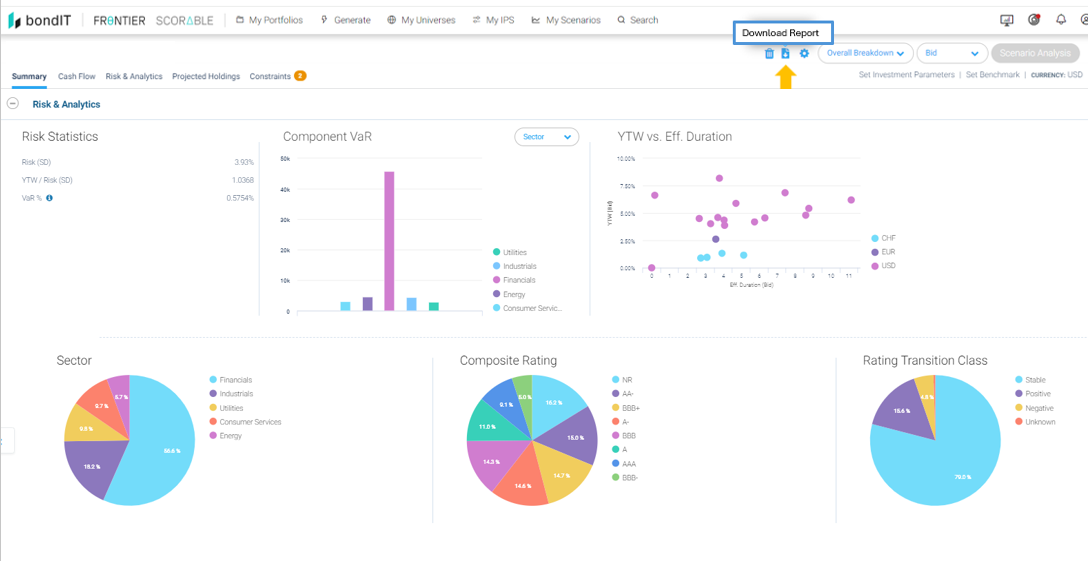

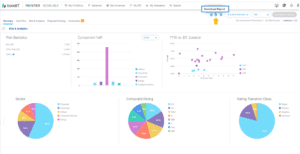

As the fixed income market continues to evolve, the need for efficient portfolio management and insightful reporting has never been greater. bondIT answers this demand with next-generation technology designed specifically for fixed income portfolios. Combining powerful analytics with user-friendly reporting features, bondIT simplifies the complexities of bond management, making it easier than ever to oversee even the most complex portfolios.

With an industry-leading suite of fixed income-specific reports, bondIT empowers advisors and portfolio managers to effortlessly track, analyze, and optimize their portfolios. Whether it’s monitoring cashflows, performing scenario analyses, or keeping up with bond maturities, bondIT’s comprehensive tools deliver clear, actionable insights at every step. By automating many of the time-consuming tasks involved in fixed income reporting, bondIT allows you to focus on making informed investment decisions while ensuring compliance and maximizing performance.

Here’s a breakdown of how bondIT makes fixed income reporting easy and efficient:

- Live Portfolios

As well as being visible in our desktop, your portfolios, holdings and analytics are available in PDF reports with your Branding, Contact Details and Correct Compliance Disclosures included. These can be augmented through the inclusion of all the reports shown below.

- Restructuring Proposals

bondIT delivers restructuring proposals in a convenient PDF format, allowing portfolio managers to compare new proposals with their existing portfolios. The tool highlights changes such as buys and sells, accompanied by before-and-after analytics that provide clear insights into the impact of portfolio adjustments.

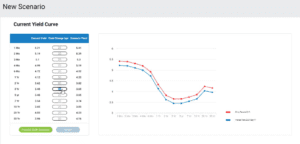

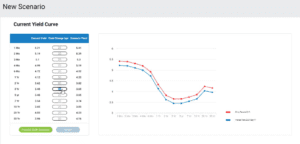

- Scenario Analysis Report

bondIT’s scenario analysis tools also come in PDF format, enabling advisors to analyze client portfolios by considering parallel rate shifts. This type of analysis can be included in a comprehensive reporting pack, helping advisors make informed decisions in varying market conditions.

- Bond Maturity Report

Tracking upcoming bond maturities is crucial, and bondIT makes it easy. Our bond maturity report helps advisors stay on top of expiring bonds and develop strategies for reinvestment or liquidity management.

- Cashflow Report

Understanding the cashflow from coupon payments or principal repayments is made simple with bondIT’s cashflow reports. Whether focusing on coupon income or principal-only cashflows, advisors get a clear picture of upcoming cashflows, helping with liquidity planning.

- Trading Report

bondIT offers transparency by including closed positions in its reports. Advisors can see which bonds have been sold, along with a detailed change log that records all adjustments made to the portfolio.

- Rating Change History Report

Staying informed about credit risk is crucial in fixed income investing. bondIT includes a history of bond rating changes in its reporting, helping advisors assess the evolving credit quality of their holdings.

- Compliance Report

Ensuring that portfolios are in compliance with investment mandates and regulatory requirements is straightforward with bondIT’s compliance reporting tools, which help advisors monitor adherence to guidelines.

Further reporting is available on request. All our reports are accessible in our desktop and can be exported to Excel.

Ready to automate your fixed income?

Try bondIT and experience the next generation of fixed income portfolio management technology. Contact a member of the bondIT team now.