Fixed income investments play a vital role in building well-diversified and risk-adjusted portfolios, providing a steady source of income, capital preservation, and the potential for appreciation. However, constructing and managing fixed-income portfolios can present a range of challenges, particularly when navigating complex debt securities markets and global economic factors. Our AI-driven platform offers the ideal solution for investors seeking to optimize their fixed-income portfolio construction and management processes, combining innovative technology, advanced data analytics, and artificial intelligence.

In this article, we will explore the benefits offered by our AI-driven platform for fixed-income portfolio optimization, discussing how its cutting-edge features bring efficiency, performance, and scale to the investment process. We will delve into the ways in which we help investors overcome the challenges of fixed-income investing, delivering superior risk-adjusted returns and enhancing their decision-making capabilities. Whether you are a seasoned fixed-income investor or in search of innovative solutions to optimize your investment processes, understanding the power of bondIT’s AI-driven platform is essential for success in today’s competitive financial markets.

- Overcoming Fixed Income Investing Challenges with AI-Driven Solutions

Investing in fixed-income securities requires navigating a complex landscape of issuers, credit risks, and market conditions. Our AI-driven platform can help investors overcome these challenges by offering powerful tools and insights that address various aspects of fixed-income investing:

– Tailored portfolio construction: Our platform uses artificial intelligence to generate optimal portfolios based on an investor’s specific risk profile, investment goals, and preferences. This eliminates the need for manual calculations and streamlines the fixed-income investing process.

– Advanced risk management: Our advanced analytics provide insights into key risk factors, such as credit, interest rate, and liquidity risks, enabling investors to make informed risk-management decisions and create more resilient portfolios.

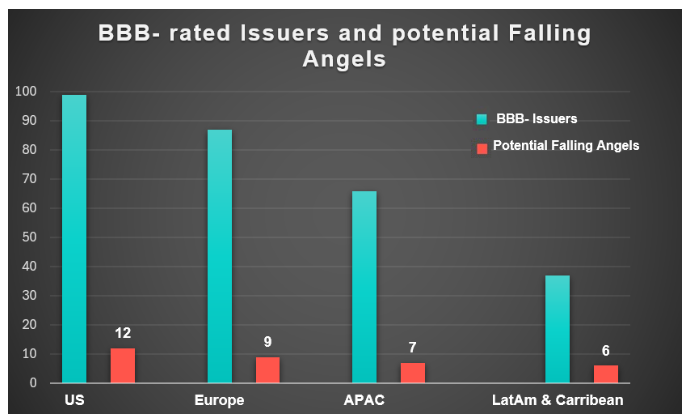

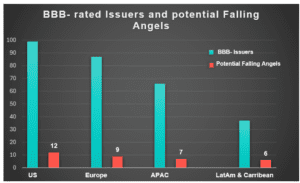

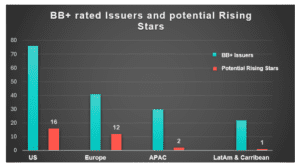

– Data-driven insights: Our platform is fully data-agnostic and supports the integration of any third-party or proprietary data. In combination with our AI-powered Credit Analytics, it offers valuable insights that can help investors capitalize on timely investment opportunities and adapt to changing market conditions.

- Key Features of Our Platform for Fixed Income Portfolio Optimization

Our comprehensive platform offers a range of powerful features designed to enhance the fixed-income portfolio construction and management process:

– AI-powered portfolio generation: Our platform combines machine learning algorithms, credit analytics, and global market data to create customized fixed-income portfolios tailored to meet each investor’s unique requirements.

– Customizable investment parameters: Investors can configure their fixed-income portfolios by incorporating custom constraints and preferences, such as duration targets, credit rating restrictions, and sector allocations, ensuring that investment decisions align with their objectives and values.

– Automated trade recommendations: Our platform can suggest trade ideas based on client’s specific needs, risk profiles, and investment objectives, streamlining their bond selection process.

– Performance and risk analytics: Our platform offers advanced analytics tools that enable investors to monitor and evaluate their fixed-income portfolios’ performance, risk exposure, and compliance continuously.

- Enhancing Decision-Making and Client Services with bondIT’s Platform

Our AI-driven platform not only streamlines fixed-income portfolio construction but can also enhance the overall advisory and decision-making process:

– Robust reporting and visualization tools: Our platform features customizable and comprehensive reporting capabilities, along with intuitive visualization tools, to help investors effectively communicate complex fixed-income concepts and strategies to clients or stakeholders.

– Unlocking untapped potential: Our AI-driven platform can uncover hidden opportunities, patterns, and trends in fixed-income markets that traditional analysis methods may not detect, empowering users to capitalize on underexplored investment opportunities.

– Staying ahead of the curve: By leveraging the most up-to-date technology and analytics, investors can stay ahead of market developments and achieve superior risk-adjusted returns.

– Strengthening client relationships: Our platform enables users to deliver personalized investment solutions and comprehensive reporting, fostering trust and strengthening client relationships.

Optimize Your Fixed Income Portfolio with bondIT’s AI-Driven Platform

Our cutting-edge AI-driven platform offers unparalleled capabilities for fixed-income investors seeking to optimize their portfolio construction and management processes. With advanced risk management tools, personalized investment solutions, and real-time market analytics, our platform empowers investors to make more informed decisions, achieve superior risk-adjusted returns, and gain a competitive edge in today’s complex financial markets.

Don’t miss out on the potential for groundbreaking success in fixed-income investing. Request a demo of bondIT’s AI-driven platform today and discover how you can harness artificial intelligence for fixed-income portfolio optimization, competitiveness, and growth.