The world of investment management is continuously evolving, fueled by advancements in technology and the growing popularity of artificial intelligence (AI) in the financial industry. bondIT’s AI-driven platform is revolutionizing investment processes by offering powerful tools and analytics that enable investors to make better-informed decisions and optimize their portfolio performance.

In this article, we will delve into the five essential principles for successful investment management using bondIT’s innovative solutions. These key principles will help guide you in embracing this cutting-edge technology, streamlining your investment processes, increasing efficiency, and ultimately improving your portfolio’s overall performance. Understanding and adopting these five principles will empower you to harness the full potential of bondIT’s platform and thrive in the ever-evolving investment landscape.

- Leverage AI for Precision in Portfolio Optimization

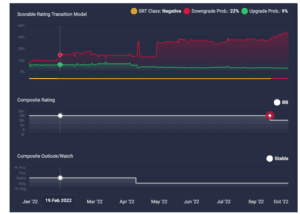

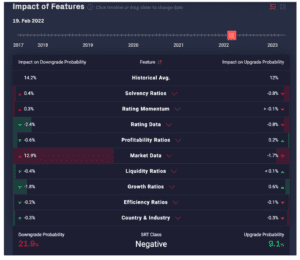

One of the primary advantages of utilizing bondIT’s AI-driven platform is the ability to optimize your portfolio with greater precision. The platform’s machine learning algorithms analyze historical data and market trends to make informed forecasts and identify potential investment opportunities more accurately than traditional methods. By leveraging AI, you can enhance your decision-making processes, minimize risks, and increase potential returns.

To take full advantage of this principle, it’s essential to understand and trust the AI recommendations provided by bondIT. Their proprietary algorithms continually learn from new data to provide reliable, data-driven insights. Incorporating these insights into your investment strategy can help you achieve a more balanced and well-performing portfolio.

- Harness Data Analytics for Informed Decision-Making

bondIT’s platform offers a range of powerful data analytics tools that enable investors to make more informed decisions when constructing and managing their portfolios. These tools provide deep insights into critical factors such as risk, volatility, and expected returns. By harnessing the power of data, investors can identify and exploit opportunities that may otherwise go unnoticed, ultimately contributing to superior portfolio performance.

Regularly monitoring performance indicators and employing advanced analytics will enable you to adapt your investment strategies as market conditions change, ensuring that your portfolio stays balanced and optimized.

- Focus on Risk Management through Diversification

When using bondIT’s AI-driven platform, it’s crucial not to lose sight of the importance of diversification as a critical risk mitigation strategy. Diversification is the practice of spreading investments across multiple asset classes, sectors, and regions to reduce overall portfolio risk. By constructing a well-diversified portfolio, investors can minimize their exposure to adverse market events, leading to more stable returns in the long run.

bondIT’s platform offers valuable support in building and maintaining diversified portfolios. Its advanced analytics and AI-driven insights can assist you in identifying investment opportunities that complement and balance your existing holdings. Moreover, bondIT’s platform enables you to monitor portfolio diversification in real-time easily, allowing you to make adjustments as needed to maintain risk-reducing balance.

- Embrace Automation for Enhanced Efficiency

One of the most significant advantages of employing AI-driven technology in investment management is the efficiency gains achieved through automation. bondIT’s platform automates many time-consuming manual tasks, such as data analysis, portfolio rebalancing, and performance monitoring. By embracing automation, investors can significantly enhance their efficiency, enabling them to focus on more strategic aspects of their investment management processes.

To fully benefit from the automation capabilities offered by bondIT, it’s essential to identify and implement the platform’s automation features within your investment processes. By delegating repetitive tasks to the platform, you can free up valuable time, allowing you to focus on devising innovative investment strategies, improving client relationships, and ultimately driving better investment outcomes.

- Adopt a Continuous Learning Mindset

The world of AI-driven investment management is continually evolving, with new technology developments and improvements emerging regularly. To stay ahead of the curve and capitalize on new opportunities, it’s crucial to adopt a continuous learning mindset when using bondIT’s platform.

To incorporate this essential principle, actively seek and engage in learning opportunities related to AI-driven investment management. Keep yourself informed on the latest industry developments, attend relevant workshops or webinars, and network with peers to exchange knowledge and experiences. Be receptive to new ideas and strive to refine and enhance your skills in using bondIT’s AI-driven platform.

Adopting a Client-Centric Approach

In addition to the five principles mentioned above, it’s crucial to maintain a client-centric approach when using bondIT’s AI-driven platform. Always focus on understanding your clients’ needs, preferences, and risk tolerance, and use the platform’s insights to create customized, client-focused investment solutions.

bondIT’s platform offers powerful tools for assessing your clients’ risk profiles and customizing portfolios to meet their specific objectives. By incorporating these tools into your investment processes, you can ensure that you genuinely cater to your clients, fostering long-lasting relationships and driving client satisfaction.

Adopting these five principles when using bondIT’s AI-driven platform can significantly enhance your investment management processes. By leveraging AI for precision, focusing on data analytics, prioritizing risk management through diversification, embracing automation, and maintaining a continuous learning mindset, you can optimize your portfolio performance, increase efficiency, and maximize expected returns. Moreover, by maintaining a client-centric approach, you can forge long-lasting relationships and secure your position as a trusted and reliable investment professional.

Unlock the Full Potential of AI-Driven Investment Management

Embracing the five key principles outlined in this article, combined with a client-centric approach, can significantly improve your investment management processes using bondIT’s AI-driven platform. By leveraging AI for precision, harnessing data analytics, focusing on diversification, embracing automation, and fostering continuous learning, you can stay ahead of the competition in the ever-evolving investment landscape.

Experience the power of AI-driven investment management software with bondIT’s innovative platform. Our comprehensive suite of tools offers unparalleled efficiency, insights, and performance for your investment portfolio. Don’t miss out on the opportunity to optimize your investment process. Request a demo of the bondIT investment management software platform today and revolutionize your investment strategies.