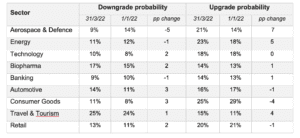

Credit upgrade probability in the Aerospace & Defence sector rises by 7% in the first quarter of the year

April 27, 2022

- bondIT’s Scorable Credit Upgrade & Downgrade Forecast indicates that upgrade probability across the Aerospace & Defence sector has increased by 7% in Q1 2022 1

- Upgrade probability across the Energy and Travel & Tourism sectors has also increased by 5% and 4% respectively over the first three months of 2022 2

- The Automotive and Consumer Goods sectors see biggest rise in downgrade probability – 3% each 3

- bondIT’s predictive credit analytics, powered by machine learning and explainable-AI, analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios

London/Berlin/Israel, 27 April 2022 – The latest Scorable Credit Upgrade & Downgrade Forecast from bondIT, a provider of next-gen fixed income technology, indicates that the probability of achieving a positive change to a credit rating has increased most in the Aerospace & Defence sector in the first quarter of 2022. Conversely, the risk of a downgrade has risen most in the Automotive and Consumer Goods sectors.

Across the Aerospace & Defence sector, credit issuers have, on average, a 21% probability today of achieving a rating upgrade within the next 12 months, versus 14% three months ago (+7%). Upgrade probabilities have also risen in the Energy sector, from 18% since the start of the year to 23% (+5%) at the end of March.

Similarly, in Travel & Tourism, the average probability for an upgrade has increased by +4% (from 11% to 15%) over the past three months. However, credit issuers in the sector are becoming more polarised into winners and losers from a credit risk perspective, as the average risk of downgrades has also increased by 1% and Travel & Tourism companies are still those which, on average, carry the highest probability of a rating downgrade (25% today versus 24% three months ago).

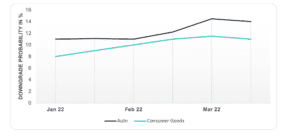

The average downgrade probability for the Automotive sector has increased by 3% in Q1 2022, from 11% to 14%, whilst the Consumer Goods sector downgrade probability has increased by the same amount, from 8% to 11%.

bondIT’s predictive credit analytics platform, Scorable, harnesses machine learning and explainable-AI to analyse more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads, and anticipate rating changes and investment opportunities, ahead of the market.

Aerospace & Defence, Energy and Travel & Tourism Sectors – Upgrade Probability Over Q1 2022

Automotive and Consumer Goods Sectors – Downgrade Probability Over Q1 2022

Dr. David Curtis, Head of Global Client Business for bondIT, said: “Against the backdrop of the market volatility created by inflation, the war in Ukraine, central banks weaning markets off stimulus, and a cost of living crisis in many global economies, our predictive credit analytics show a highly changeable environment for credit investors. These macro issues have meant that, in some sectors, the probability of a credit upgrade or downgrade is materially different to three months ago. Moreover, the picture is not uniform within sectors – the average probability for an upgrade has risen in Travel & Tourism but so has the average probability of a downgrade. In other words, companies’ fortunes are no longer simply rising or falling with the macro tide but are becoming increasingly polarised. This, in theory, should be a period where active fund managers can demonstrate significant value through their security selection.”

About bondIT

bondIT provides next generation front office investment technology. We combine Data Science, Explainable-AI (XAI) and Advanced Technologies with Fixed Income investment know-how to improve the performance, accuracy and efficiency of our clients’ investment processes and businesses. Our technology enables clients to efficiently build, analyze and rebalance investment portfolios, and achieve within minutes what previously took hours or days. Thanks to bondIT’s predictive credit analytics, investors can anticipate changes in corporate credit risk and capitalise on investment opportunities ahead of the market. The platform is highly flexible, being data agnostic and API or cloud based, and allows for the seamless onboarding of internal models as well as downstream connectivity to existing portfolio management and trading systems. bondIT is privately owned and paving the way for financial institutions of all sizes to integrate the power of greater technology in their investment processes. For more information, please visit www.bonditglobal.com.