2023 Credit Risk Outlook: Household Goods & Household Product Industries Face Highest Rating Downgrade Risk, Followed by Travel & Tourism and Airlines

December 6, 2022

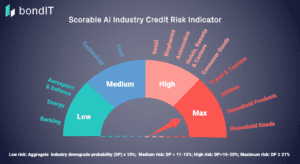

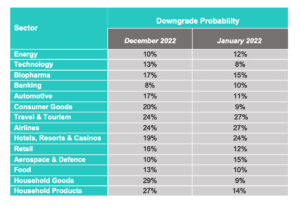

New York/London/Tel Aviv (Herzliya), 6 December 2022 — According to bondIT‘s Scorable AI Industry Credit Risk Indicator, the industries with the highest risk of rating downgrades in 2023 are Household Goods (29%) and Household Products (27%), followed by Travel & Tourism (24%) and Airlines (24%).

Industries with the lowest aggregate downgrade probability in the next year include Aerospace & Defence (10%); Energy (10%) and Banking (8%).

The latest analysis from bondIT, a provider of credit analytics and next-gen fixed income technology, indicates that the probability of a rating downgrade has increased most within the Households Goods industry, rising from 9 per cent in January to 29 per cent December 2022. Household Products – which includes hygiene, personal, beauty, home care, health, and nutrition brands – saw the second highest increase of aggregated downgrade risk to credit this year, from 14 to 27 per cent.

Whilst the Airlines industry and Travel & Tourism saw a small drop in rating downgrade probability since the start of the year (-3%), overall credit risk across these sectors remains high at 24 percent.

bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probability of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month timeframe. The Rating Transition Model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads, and anticipate rating changes and investment opportunities, ahead of the market.

For more information, please contact the bondIT team.

ABOUT bondIT

bondIT provides next generation front office investment technology. We combine Data Science, Explainable-AI (XAI) and Advanced Technologies with Fixed Income investment know-how to improve the performance, accuracy and efficiency of our clients’ investment processes and businesses. Our technology enables clients to efficiently build, analyze and rebalance investment portfolios, and achieve within minutes what previously took hours or days. Thanks to bondIT’s predictive credit analytics, investors can anticipate changes in corporate credit risk and capitalize on investment opportunities ahead of the market. The platform is highly flexible, being data agnostic and API or cloud based, and allows for the seamless onboarding of internal models as well as downstream connectivity to existing portfolio management and trading systems. bondIT is privately owned and paving the way for financial institutions of all sizes to integrate the power of greater technology in their investment processes. bondIT adheres to the highest privacy and security standards and is SOC 2 certified by Ernst & Young. For more information, please visit www.bonditglobal.com.