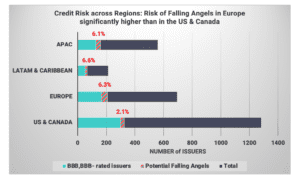

Credit Risk Across Regions: Falling Angels in Europe set to outnumber their US peers

September 28, 2022

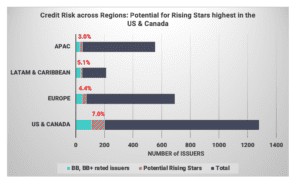

bondIT’s AI-driven Credit Analytics predicts that US will see most Rising Stars in the next year

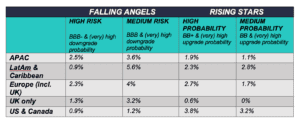

Scorable, bondIT’s AI-driven Credit Analytics, indicates that 6.3% of corporate and financial issuers in Europe are at high or medium risk of becoming Falling Angels* in the next 12 months, compared to only 2.1% of US issuers. The analysis also shows that the US and Canada will see the highest number of Rising Stars** in the next 12 months, with more than 90 companies (7.0%) having a high or medium probability of transitioning from high-yield to investment-grade.

David Curtis, Partner at bondIT, said: “The economic outlook across the globe is increasingly bleak as sky-high inflation and rising interest rates dampen the outlook. Companies in Europe are disproportionately affected by supply shortages and mounting energy insecurity as Russia’s invasion of Ukraine continues. However, in spite of rising bond yields, there is opportunity for investors to generate strong returns – if they manage their exposures well. Anticipating directional credit changes early helps to effectively manage risk, discover new investment opportunities, and build portfolios that optimally balance risks and returns in this challenging environment.”

bondIT’s analysis looks at BBB- and BB+ rated issuers, which sit directly at the intersection of investment-grade and high-yield and are therefore most likely to become Falling Angels or Rising Stars. In addition, BBB and BB rated issuers with high rating transition probabilities were also included.

Scorable, bondIT’s credit analytics platform, harnesses machine learning and explainable-AI to predict downgrade and upgrade probability of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month timeframe. The Rating Transition Model analyses more than 250 data variables daily including solvency ratios, capital requirements, profitability, and efficiency ratios.

* Companies at risk of becoming Falling Angels are issuers with (very) high downgrade probability, according to Scorable’s Rating Transition Model, and BBB- rating (high risk) or BBB rating (medium risk)

** Companies likely to become Rising Stars are issuers with (very) high upgrade probability, according to Scorable’s Rating Transition Model, and BB+ rating (high probability) or BB rating (medium probability)