Navigating Credit Risk: Insights from bondIT’s Q4 Analysis

October 30, 2024

Rising Stars Set to Outpace Falling Angels Across Key Markets

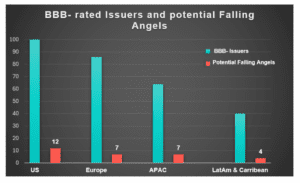

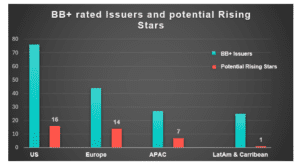

Our recent analysis reveals key trends among Falling Angels and Rising Stars across various regions, including the US, Europe, Asia-Pacific, and Latin America. It also highlights the industries most vulnerable to rating downgrades.

- Overall Trends: The risk of Falling Angels remains consistent with the previous quarter, with 30 potential Falling Angels identified. Rising Stars are still expected to outnumber Falling Angels, with 38 potential Rising Stars—a slight decrease of 1 from Q3.

- Regional Disparities: In the US and Europe, Rising Stars are projected to outnumber Falling Angels over the next 12 months. In contrast, Asia-Pacific sees an even distribution between the two, marking an improvement from the last quarter when Falling Angels were expected to outnumber Rising Stars. Latin America, however, is forecasted to see more Falling Angels than Rising Stars, highlighting ongoing credit challenges in the region.

Thriving Amid Economic Transition

The global economy is undergoing a transition as interest rates begin to come down, alleviating some of the pressure on borrowing costs for corporations. While this shift could support credit conditions in the medium term, uneven growth rates, inflationary pressures, and geopolitical uncertainties still pose challenges, especially for companies with weaker credit profiles. In this environment, proactive credit risk assessment remains crucial, enabling investors to anticipate potential downgrades and adjust their portfolios to protect against losses.

Despite these uncertainties, the bond market offers compelling opportunities for investors seeking attractive yields and potential gains. With interest rates easing, careful selection of issuers becomes even more critical to manage risk and optimize outcomes. Spotting rising stars early in their credit cycle can yield substantial returns, turning these market dynamics into a strategic advantage.

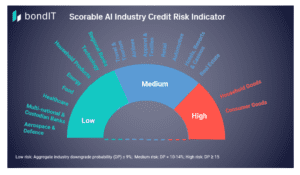

Industry-Specific Credit Challenges

In the coming 12 months, our analysis identifies Household Goods (18%) and Consumer Goods (15%) as the sectors with the highest aggregate downgrade probability. These sectors remain under pressure as evolving consumer preferences, lingering inflation, and economic volatility weigh on their financial resilience. The combination of these factors could lead to reduced profitability and a heightened probability of rating downgrades in the near future.

While the Real Estate sector has shown improvement, moving from the high-risk to the medium-risk category (12% downgrade probability), the Automotive sector has transitioned from low to medium risk (11%). This shift in the Automotive sector can be attributed to factors like supply chain disruptions, rising raw material costs, and the industry’s slow adaptation to electric vehicle demand, which have intensified financial pressures on traditional automakers.

Leveraging bondIT’s Advanced Analytics for Smarter Decisions

Investors can better navigate the complexities of credit risk by leveraging advanced analytics and staying attuned to macroeconomic trends. bondIT equips investors with powerful tools that enable them to make informed decisions, enhancing their ability to optimize returns while managing exposure effectively in today’s dynamic financial environment.

Advanced Analytics with bondIT’s Scorable Platform

bondIT’s credit analytics platform, Scorable, utilizes machine learning and explainable AI to forecast downgrade and upgrade probabilities for nearly 3,000 rated corporate and financial issuers worldwide over a 12-month horizon. Our Rating Transition Model examines over 250 data variables daily, including solvency ratios, capital requirements, profitability, and efficiency metrics. The platform delivers actionable insights that allow investors to anticipate rating changes, monitor corporate bond ratings and spreads, and uncover investment opportunities ahead of the market.

Want to find out which companies are most likely to become Falling Angels or Rising Stars? Log into Scorable now or contact our team for more info.