Navigating Credit Risk: Insights from bondIT’s Latest Analysis

July 22, 2024

Understanding credit risk is crucial for investors aiming to optimize returns while managing exposure in today’s ever-changing financial environment. bondIT’s latest credit risk analysis, powered by Scorable, offers a comprehensive view of the risk and opportunity landscape for corporate and financial issuers worldwide.

Rising Stars to outnumber Falling Angels in the US and Europe

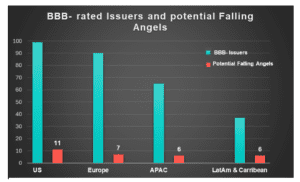

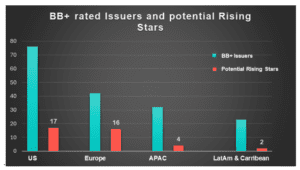

Our recent analysis highlights the trends among Falling Angels and Rising Stars across various regions, including the US, Europe, Asia-Pacific, and Latin America. It also sheds light on the industries most at risk of rating downgrades.

- Overall Trends: There’s a modest improvement in credit risk, with 30 potential Falling Angels (a decrease of 4 from Q2) and 39 Rising Stars (an increase of 8 from Q2).

- Regional Disparities: In the US and Europe, Rising Stars are set to outnumber Falling Angels over the next 12 months. Conversely, in Asia-Pacific and Latin America, the number of Falling Angels is predicted to exceed Rising Stars, indicating regional disparities in credit risk.

Currently, the global economy is navigating through a landscape marked by varying economic growth rates, inflationary pressures, and geopolitical uncertainties. Higher rates have translated to higher borrowing costs for corporations, potentially leading to increased credit risk, especially for highly leveraged companies. Investors must be vigilant in assessing credit quality and the ability of issuers to service their debt in a tightening monetary environment. Identifying issuers with a worsening credit risk profile and potential falling angels early, enables investors to mitigate losses by adjusting their portfolios timely.

Despite these challenges, the bond market offers investors significant opportunities with attractive yields and potential for gains. The key lies in investing in the right issuers, as careful selection can mitigate risks and optimize outcomes. Moreover, spotting a rising star early in the market cycle can result in substantial returns.

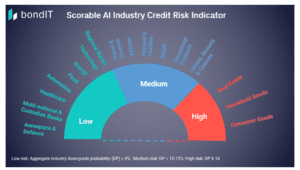

Industry-Specific Risks

Across industries, Household Goods (18%), Consumer Goods (15%) and Real Estate (15%) have the highest aggregate downgrade probability in the next 12 months. These sectors are particularly vulnerable due to factors such as shifts in consumer spending, high interest rates, and economic uncertainty. Additionally, the Airlines and Household Goods sectors have seen the most significant increases in credit risk over the past quarter, with upticks of 3% and 4%, respectively. These vulnerabilities underscore the importance of sector-specific analysis in credit risk management.

By leveraging advanced analytics and staying attuned to macro-economic trends, investors can better navigate the complexities of credit risk. bondIT equips investors with the necessary tools to make informed decisions, enhancing their ability to optimize returns while managing exposure effectively in today’s dynamic financial environment.

Advanced Analytics with bondIT’s Scorable Platform

bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probabilities of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month timeframe. Our Rating Transition Model analyzes more than 250 data variables daily, including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads and anticipate rating changes and investment opportunities ahead of the market.

Contact us now for a demo or free trial.