Navigating Credit Risk: Insights from bondIT’s Latest Analysis

April 12, 2024

In today’s dynamic financial landscape, understanding credit risk is paramount for investors seeking to maximize returns while managing exposure. bondIT’s credit risk analysis, powered by Scorable, offers insights into the delicate balance between risk and opportunity for corporate and financial issuers globally.

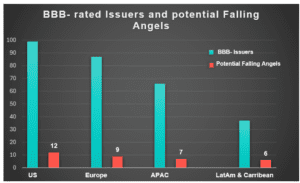

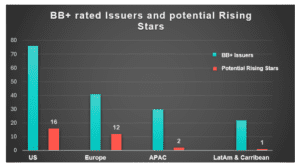

Our latest analysis delves into the dynamics of Falling Angels* and Rising Stars** across key regions, including the US, Europe, Asia-Pacific, and Latin America. Our findings reveal a balanced mix of credit risks, with 34 potential Falling Angels versus 31 Rising Stars. However, regional nuances are noteworthy: while Rising Stars slightly outnumber Falling Angels in the US and Europe for the next 12 months, Asia-Pacific and Latin America present a higher risk of Falling Angels.

In the face of such mixed outlooks and amidst volatile global political and economic conditions, investors need to take proactive steps in managing credit risk. Yet, amidst the challenges lie abundant opportunities in the bond market, characterized by attractive yields and potential gains. Identifying a rising star at the opportune stage of the market cycle can yield substantial returns for savvy investors.

bondIT’s credit analytics platform, Scorable, harnesses machine learning and explainable-AI to predict downgrade and upgrade probabilities of nearly 3,000 rated corporate and financial issuers worldwide within a 12-month timeframe. Our Rating Transition Model analyzes more than 250 data variables daily, including solvency ratios, capital requirements, profitability, and efficiency ratios. The platform provides actionable insights for investors, allowing them to monitor corporate bond ratings and spreads and anticipate rating changes and investment opportunities ahead of the market.

As part of our ongoing commitment to consistently improve our model performance, we recently rolled out an enhanced version of our Scorable Model. This update is designed to provide users with even more accurate credit predictions, empowering investors with the tools they need to navigate the evolving landscape with confidence.

Key Improvements include:

Enhanced Features: Integration of new fundamental and market data features to bolster prediction accuracy.

Retraining: Our model has been retrained using the most recent data available until January 2024, optimizing its performance.

Unified Model: A unified model catering to both banks and corporates, maximizing efficiency without compromising accuracy.

Code Improvements: Fine-tuning of the model’s code to enhance performance and reliability.

Stay ahead of the curve with bondIT’s enhanced Scorable Model. Contact the bondIT team now for a free trial or to book a short demo.

*Potential Falling Angels are BBB- rated issuers with a high downgrade probability in the next 12 months according to our Scorable model.

**Potential Rising Stars are BB+ rated issuers with a high upgrade probability in the next 12 months according to our Scorable model.