bondIT’s Q1/25 Credit Analysis: Falling Angels Are On The Rise

January 16, 2025

In today’s dynamic financial environment, understanding credit risk is key to making informed investment decisions that balance potential returns with exposure. bondIT’s latest analysis, powered by Scorable, delivers an in-depth perspective on the evolving credit landscape, highlighting both risks and opportunities for corporate and financial issuers around the globe.

Key Trends in Credit Dynamics: Falling Angels on the Rise

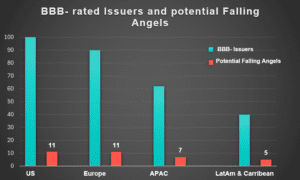

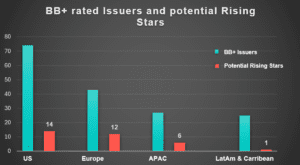

Our recent analysis reveals significant developments among Falling Angels* and Rising Stars** across various regions, including the US, Europe, Asia-Pacific, and Latin America. It also highlights the industries most vulnerable to rating downgrades.

- Overall Trends: The risk of Falling Angels has increased compared with the previous quarter, with 34 potential Falling Angels identified, up from 30 in Q4/2024. Falling Angels are now predicted to outnumber Rising Stars with only 33 BB+ rated issuers expected to see upgrades in the near future – compared to 37 in the last quarter

- Regional Disparities: In the US and Europe, Rising Stars are still projected to outnumber Falling Angels over the next 12 months, but the margin is narrowing. In Asia-Pacific and Latin America, Falling Angels are forecasted to exceed Rising Stars, underscoring persistent credit challenges in these regions.

Adapting to a Shifting Economic Landscape

As the global economy adjusts to declining interest rates, corporations are beginning to feel some relief from elevated borrowing costs. This transition presents opportunities for stronger credit conditions in the medium term. However, persistent headwinds—ranging from inflationary pressures to uneven regional growth and geopolitical complexities—continue to test the resilience of businesses, particularly those with fragile credit profiles.

For investors, this shifting environment underscores the need for enhanced vigilance. Leveraging advanced tools and analytics to assess creditworthiness proactively can help mitigate risks and position portfolios for success.

Meanwhile, the bond market offers compelling opportunities. Easing rates create favorable conditions for early identification of rising stars—issuers with improving credit trajectories that can deliver substantial returns. By spotting these trends ahead of the curve, investors can transform macroeconomic challenges into a strategic advantage, optimizing their portfolios for growth and stability.

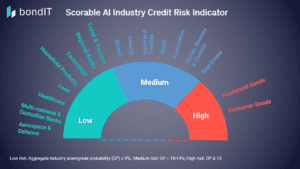

Industry-Specific Credit Challenges

In the coming 12 months, our analysis identifies Household Goods (19%) and Consumer Goods (16%) as the sectors with the highest aggregate downgrade probability, both experiencing a slight increase in credit risk (+1%) since the last quarter. These industries face challenges from evolving consumer behaviors, persistent inflation, and economic instability, which continue to strain profitability and elevate downgrade risks.

Travel & Tourism has emerged as the biggest improver this quarter, with downgrade probability falling to 8% from 11%. Pent-up demand, despite tight budgets, is driving growth in this sector. Conversely, the Energy sector has seen a modest increase in credit risk to 10%, moving it from the low to the medium-risk category. Stabilizing commodity prices provide some relief, but the sector faces pressures from the global transition to renewable energy and the need for significant capital investment.

Leveraging bondIT’s Advanced Analytics for Smarter Decisions

Investors can better navigate the complexities of credit risk by leveraging advanced analytics and staying attuned to macroeconomic trends. bondIT equips investors with powerful tools that enable them to make informed decisions, enhancing their ability to optimize returns while managing exposure effectively in today’s dynamic financial environment.

Advanced Analytics with bondIT’s Scorable Platform

bondIT’s credit analytics platform, Scorable, utilizes machine learning and explainable AI to forecast downgrade and upgrade probabilities for nearly 3,000 rated corporate and financial issuers worldwide over a 12-month horizon. Our Rating Transition Model examines over 250 data variables daily, including solvency ratios, capital requirements, profitability, and efficiency metrics. The platform delivers actionable insights that allow investors to anticipate rating changes, monitor corporate bond ratings and spreads, and uncover investment opportunities ahead of the market.

Want to find out which companies are most likely to become Falling Angels or Rising Stars? Log into Scorable now or contact our team for more info.

* Potential Falling Angels are BBB- rated issuers with a high downgrade probability in the next 12 months according to our Scorable model.

**Potential Rising Stars are BB+ rated issuers with a high upgrade probability in the next 12 months according to our Scorable model.