Transforming Wealth Management Direct Indexing in Fixed Income

Discover the Future of Fixed Income Investing

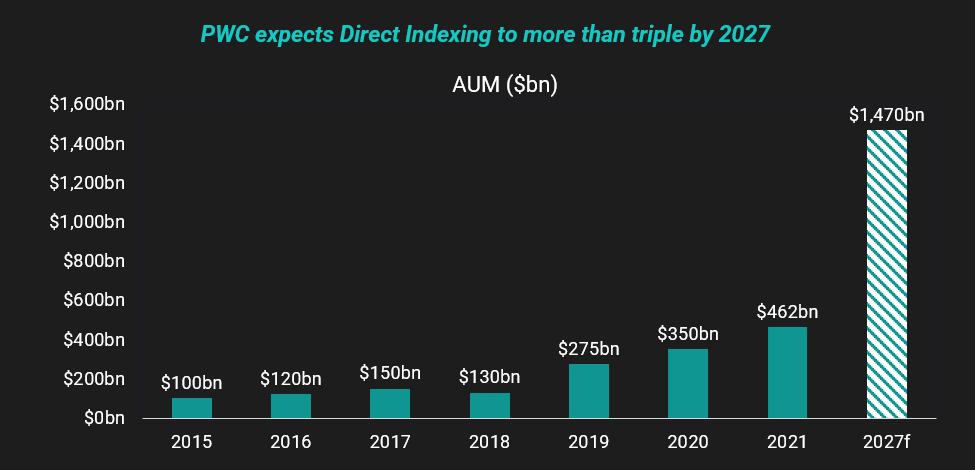

The landscape of investment management is evolving rapidly, driven by technological advancements and a growing desire for tailored financial solutions. As we navigate through a changing economic environment, bonds have once again emerged as a crucial investment avenue. Direct indexing, once primarily associated with equity investments, is now expanding its reach into fixed income markets.

Bonds are Back, but the Market has Changed

With rising interest rates, bonds have regained their appeal, offering stability in uncertain times. However, the dynamics of the fixed income market have evolved significantly. As traditional players like corporate defined benefit plans recede, individual investors and advisors are taking center stage, prioritizing predictable cash flows and tax efficiency over benchmark performance.

Introducing Direct Indexing to Fixed Income

Direct indexing, previously synonymous with equity investments, is now extending its reach into fixed income markets. However, given the unique dynamics of the fixed income landscape, direct indexing alone may not fully align with the objectives of individual investors. Access and transaction costs remain a limiting factor, and broad-based indices often fail to address personalized needs. Instead, a more effective approach for fixed income involves custom direct investing, which takes into account household objectives and constraints, evaluates live market availability, and utilizes ETFs as supplementary instruments.

Discover Custom Direct Investing with bondIT

Our innovative Frontier technology allows you to build and execute customized portfolios with real-time quotes in minutes. Book your demo now!

Catering to the Needs of Today's Investors

As we emerge from a decade of low yields with fixed income back in focus, the needs of investors have changed and traditional paradigms are being challenged. While direct indexing has been a successful strategy in equity markets, many of these benefits are not directly transferable to fixed income as the tax benefit, liquidity and availability of bonds are not the same. The way forward lies in custom direct investing, where personalized portfolios tailored to individual needs can be constructed at scale, leveraging technological solutions to marry the benefits of direct indexing with the predictability of fixed income cash flows. In embracing innovation and technological advancements, advisors and wealth managers can offer their clients truly personalized investment solutions. bondIT's technology automates the creation and optimization of personalized portfolios, empowering wealth managers to efficiently make customized solutions accessible to a wide range of clients.

Embracing Innovation with bondIT

As we navigate through changing market dynamics, embracing innovation is crucial. At bondIT, we're committed to leveraging cutting-edge technology to deliver personalized investment solutions at scale. Our direct indexing capabilities marry the benefits of customization with the stability of fixed income cash flows, offering a truly transformative experience for investors and advisors alike.

Harnessing Technology for Enhanced Fixed Income Solutions

Ready to explore the transformative power of direct indexing and custom direct investing with bondIT? Download a copy of our whitepaper Is Direct Indexing Applicable to Bonds? to learn more about the latest market trends and how they're reshaping the world of fixed income investing. For a personalized demo of our portfolio management technology, contact us today.